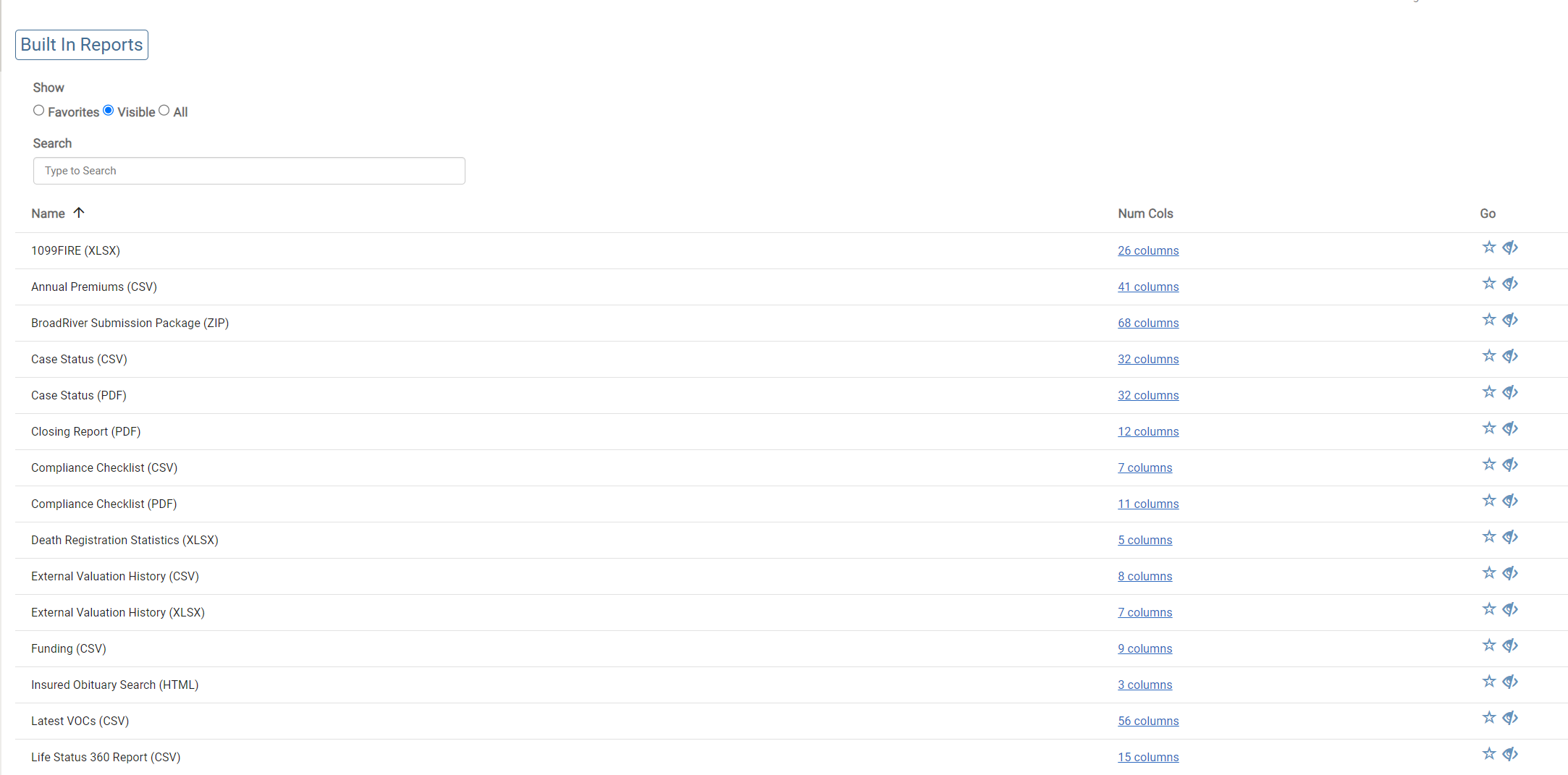

Built-in Reports

Using Built-In Reports

- Built-in Reports (as well as any Custom Reports you have created) are accessed by clicking on the Reporting icon in the header of any Case List or Portfolio.

- Built-in Reports will be formatted as CSV (Comma Separated Value), PDF (Portable Document Format), or XLSX (Excel 2013 and later format files). Reports which are published as PDF will require that you specify a Page Format when generating the report, which can be set to A4, Letter, Ledger or Legal. Reports which are published as PDF will include your company's logo (if it has been uploaded into ClariNet on the Client Information page), otherwise they will include the ClariNet logo.

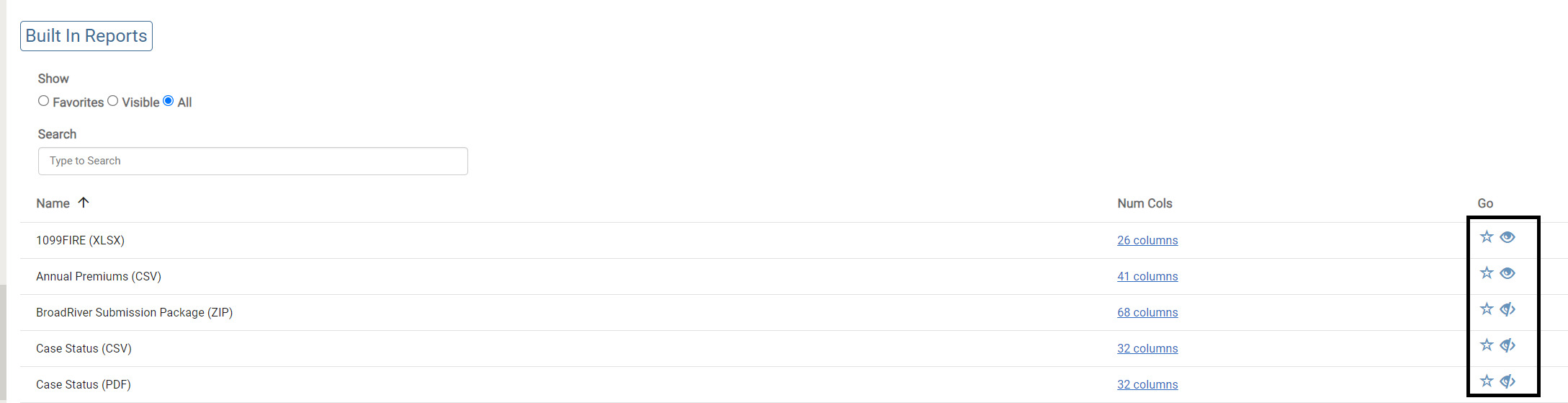

GO Column

The go column allows the feature listed below

- Favorite a built-in report

- Hide/Show a built-in Report

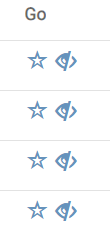

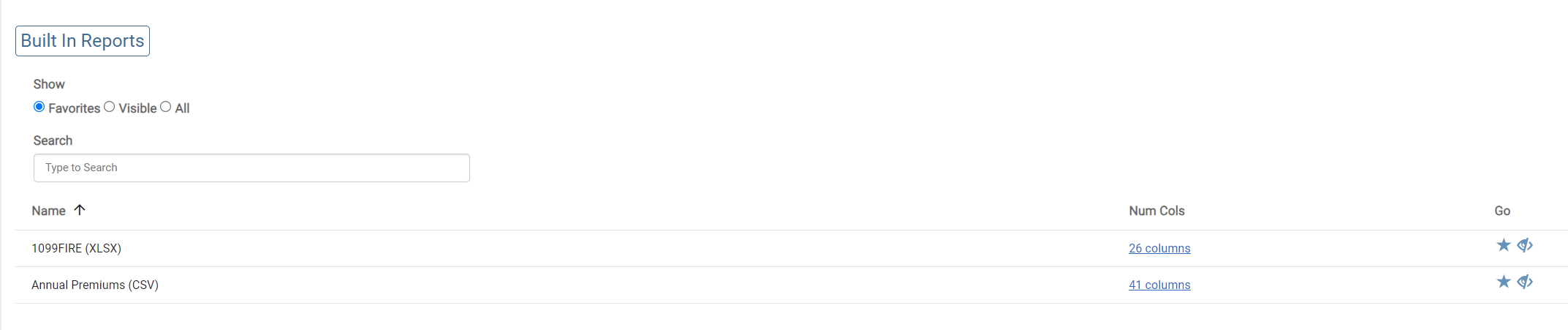

Favorite Built-In Reports

The empty Star icon under the go column allows you to favorite a report by clicking on the icon.

This feature allows you to filter your favorite reports. By having at least one report favorited, just the favorited reports will be listed whenever you access the Export and Reports page.

At least one report must be favorited to display only favorites every time you access the Exports and Reports page.

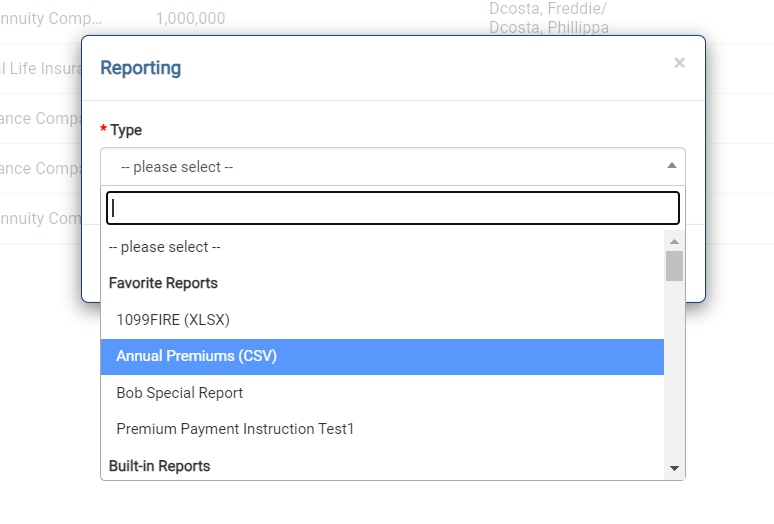

All the favorite reports will be listed first under the label Favourite Reports on reporting modals when accessed from

- Home Page

- Advanced Search Page

- Portfolios List Page.

Hiding a Built-In Report

The eye icon under the GO column allows you to hide a built-in Report. Hidden reports will be hidden from the reports list and the reporting modal.

The filters in the screenshot below allow you to filter the reports.

You must select “All” to view all the reports, including hidden ones. “Visible” must be selected to display only visible reports and are not hidden.

Example: The 1099Fire(XLSX) and Annual Premiums (CSV) reports are hidden as shown in the screenshot below. These reports are now hidden. Hence the fully open eye represents that the report is now hidden and you can click on the same to make it visible.

Hidden built-in reports will not be listed in any reporting modals.

Reports can be either hidden or favorited but not both

The list of Built-in Reports are :

Annual Premiums (CSV)

This report shows the premium payments scheduled for a Case on an annual basis. It selects the Premium Schedule based on the Valuation Settings (or shows “No PS” if no Premium Schedule is available). Fields included in the report are:

| Column1 | Column2 |

|---|---|

| Case Reference | Sender |

| State of Ownership | Carrier |

| Policy Number | Policy Date |

| Face Amount | Derived Policy Type |

| Coverage End Date (calculated based on the Policy Date, Age Basis and Maturity Age/Extended DB Rider Age) | Coverage End Age (based on Maturity Age/Extended DB Rider Age) |

| Premium Financed | Insured1Reference |

| Insured1Firstname | Insured1Lastname |

| Insured1Gender | Insured1DOB |

| Insured1SSN | Insured1Report1Underwriter |

| Insured1Report1Date | Insured1Report1LE50 |

| Insured1Report1Smoker | Insured1Report2UW |

| Insured1Report2Date | Insured1Report2LE50 |

| Insured1Report2Smoker | Insured2Reference |

| Insured2Firstname | Insured2Lastname |

| Insured2Gender | Insured2DOB |

| Insured2SSN | Insured2Report1Underwriter |

| Insured2Report1Date | Insured2Report1LE50 |

| Insured2Report1Smoker | Insured2Report2UW |

| Insured2Report2Date | Insured2Report2LE50 |

| Insured2Report2Smoker | PremiumPricingDate |

| PremiumStartDate |

Age Basis: The basis by reference to which the Insured's Attained Age is calculated; either ALB (Age Last Birthday) or ANB/ANBm (Age Nearest Birthday). ANB is the most common basis for Policies issued after 1995. ANB calculates the exact number of days from the reference date to the previous and next birthday and uses whichever is closest on that basis to determine age. For ANBm, if we are more than 6 months after the last birthday, use the next birthday as the age, otherwise, use the previous one.

The report parses the Premium Schedule into years (measured from the Start Date) and sums the Premium Payments due during each year.

Closing Report (PDF)

This report shows information about Closing Transactions for one or more Cases and is therefore relevant for Clients with the Closing module included. When selected in the Reporting dropdown, a link is shown to allow you to attach a header document (as PDF) and a footer document (also as PDF). Fields displayed in the report are:

- Case Reference;

- Insured(s) Last Name(s);

- Policy Number;

- Face Amount (with total);

- Price Allocation Total: drawn from the table of amounts on the Price Allocation tab of the Closing Transaction (and totaled for all Cases in the report); and

- Last Recorded Event: the last recorded Closing Event on the Case.

Funding (CSV)

This report generates funding information for Cases with an associated Closing Transaction. When selected in the Reporting dropdown, you are required to select a Payment Recipient (e.g., Seller, Broker, Agent) and a Closing Event. Fields displayed in the report are:

- Case Reference;

- Insured 1 Full Name;

- Insured 2 Full Name;

- Policy Number;

- Payment Recipient;

- Date Paid;

- Amount Paid;

- Payment Type; and

- Closing Event Completed (date).

Maturities (CSV)

This report lists profit information on matured/maturing Cases. When selected in the Reporting dropdown, you are required to select a Valuation Template (used to determine valuation information which is displayed in the report), Underwriter Weightings (either Valuation or Actual Expected) and a date range for the Insured DOD. Fields displayed in the report are:

- Case Reference;

- Case Status (e.g., Maturity Claim Pending);

- Face Amount;

- The following fields for each of Insured 1 and Insured 2:

- DOD;

- LE At Maturity (i.e., how many months before/after the Insured’s LE did the DOD occur);

- Age at Death;

- Purchase Cost;

- Premiums Paid (drawn from the Premium History);

- Fees Paid (drawn from the Fee History);

- Purchase Other Costs;

- Profit (calculated as on the Cost/Maturity/Disposal tab);

- Realized IRR;

- Maturity Total Amount;

- NDB Payment;

- Interest;

- Return of Premium; and

- Other Amounts.

Maturities (PDF)

This report lists profit information on matured and maturing Cases. When selected in the Reporting dropdown, you are required to select the same variable as for the CSV version. The resulting PDF is presented in landscape format. The report comprises four sections:

Summary

This lists the total number of Insured Lives, total face, total number of Policies and shows a table with these three data points broken down by Case Status (together with Average LE at Maturity and Average Age at Death).

Maturity Claim Pending

For all Cases with Status Maturity Claim Pending, this lists:

- Case Reference;

- Face Amount (with total);

- Primary/Secondary Insured DOD;

- Primary/Secondary Insured LE at Maturity; and

- Primary/Secondary Insured Age at Death.

Maturity Claim Paid

For all Cases with Status Maturity Claim Pending, this lists:

- Case Reference;

- Primary/Secondary Insured LE at Maturity;

- Face Amount (with total);

- Maturity Total Amount (with total);

- Purchase Cost (with total);

- Premiums Paid (with total);

- Fees Paid (with total);

- Other Costs (with total);

- Profit (with total); and

- Realized IRR.

Maturity Proceeds

For all Cases with Status Maturity Claim Paid, this lists:

- Case Reference;

- Maturity Total Amount (with total);

- NDB Payment (with total);

- Interest (with total);

- Return Of Premium (with total); and

- Other Amounts (with total).

Valuations by Insured (PDF)

This report lists valuation information for Cases grouped by Insured. When selected in the Reporting dropdown, you are required to select a Valuation Template and Underwriter Weightings. This report displays the following fields:

- Insured (First Name/Last Name);

- Age;

- LEs (months): this shows mean LE, Report Date and Underwriter for all LE reports for the Insured;

- Case References: lists all Cases which link to the Insured;

- State of Ownership;

- NDB ($): this shows the Face Amount from the Policy tab;

- Premium/NDB to Maturity (%): this shows the ratio of the total amount paid in the Premium Schedule (as per the Valuation Settings) to the Face Amount of the Policy; and

- Priced Value ($) at XX%: this shows the value of the Policy calculated using the selected Valuation Template using the IRR(s) set in the Base Scenario.

| Report | Description | Required Info |

|---|---|---|

| 1099FIRE (XLSX) | Basic information about the policy and the insureds in following columns: Case Reference, Name, Address, City, State, zip, Phone, Policy Number, Amount, | Start/End Date |

| Annual Premium (CSV) | The Annual Premium is the future expected Premium Schedules for each case in a portfolio, from Year 1 (Policy Date) to Coverage End Date. It contains 41 columns as listed above under The list of Built-in Reports are : Annual Premiums (CSV). | N/A |

| Payment History (XLSX) | Payment History records the previously paid premiums. This helps us to calculate more accurate future premium schedule. Case Reference, Date, Premium Amount, Fee Amount, NDB, Loan Principal Amount, Loan Interest Amount, Loan Drawdown, Cash withdrawal, Premium Schedule Month | N/A |

| Payment History Premium Paid Comparison (XLSX) | Compare the actual paid amount against premium scheduled amount. Columns includes Case Reference, Date, Payment History Amount , Premium Schedule Amount , Premium Schedule Month | N/A |

| Case Status (CSV & PDF) | Information about the case: Case Reference , Status (Active/ Not Active), Broker, Carrier, Seller, Policy Type, Policy Number, State, Face Amount, Issue Date, SSN, LE50 (21st/AVs/EMSI/Fasano/ISC/LSI/Predictive/Elevation/Lapetus/Polaris/User Define) | N/A |

| Closing Report (PDF) | Case Reference , Insured Last Name, Policy Number, Face Amount, Price Allocation Total , Last Recorded Event | Header Document, Footer Document |

| Compliance Check List (CSV & PDF) | N/A | |

| Death Registration Statistics (XLSX) | Death Certificate Gap, Discovery Gap, Latest Date of Death to Payment, Latest Discovery to Payment, Latest Death Certificate Received to Payment (Minimum/Average/Weighted/Maximum) for Last Week, Last Month, Prior Month, Last Quarter, Last Six Months, Last Year, Since Start Date | Start/End Date |

| Lyric Servicing Data (XLSX) | N/A | |

| Lyric Servicing Data with Documents (ZIP) | Export Lyric Servicing Data (XLSX) | N/A |

| Resscapital Submission Package (ZIP) | Export Resscapital Submission Package (XML) | N/A |

| BroadRiver Submission Package (ZIP) | Export BroadRiver Submission Package (XML) | N/A |

| Funding (CSV) | Payment Recipient, Closing Event | |

| Latest VOC (CSV) | If there exists VOC or annual statement that dates after the latest illustration, then we can update the following values to generate more accurate Premium Schedules: Case Reference, Policy Number, Face Amount, Carrier, Verification Date , Communication Type (weather VOC or Annual statement exist), CSR Name, Policy in Force, Policy in Grace, Account Information Date , AV , Surrender Value , CSV , Face Amount , Loan Amount, NDB, Current Premium Mode(Annual/Monthly) , Total Premium Paid to Date , Last Loan Payment Amount/Date, Last Premium Amount/Date, Next Premium Amount/Date , Paid Up Additions Purchased, Total Paid Up Additions, Annual Charges, rates related to COI, data related to Dividends, Current Crediting Rate, Collateral Assignment, info about Riders (NLG, Maturity Rider), | Number of VOC |

| Maturity (CSV & PDF) | Once the Date of Death of the insured has been set, this Maturity report will give us the following: Case Reference, Case Status, Face Amount, Insured1& Insured 2 DOD/ Death Confirmed Date/ LE at Maturity/ Age at Death , Purchase Cost, Premiums Paid, Fees Paid, Profit, Realized IRR Maturity, NDB Payment, Interest, Return of Premium | Valuation Template, Underwriter Weighting, From/To Date |

| Maturity Summary (XLSX) | The total number of Matured cases in the portfolio, and the timeline recording when each of them has matured | N/A |

| PBI Report (XLSX) | SSN, Name, DOB, City, State, Client Use (Case Reference) | N/A |

| Life Status 360 Report (CSV) | RID, Name. DOB, Gender | N/A |

| Premium Schedule and NDB Streams (XLSX) | This report contains the following excel sheets: 1. Premium Schedule (Monthly Premium cashflow from the date the report is generated to the coverage end date). 2. NDB Schedule (Monthly NDB cashflow from the date the report is generated to the coverage end date). 3. Premium Payment History (Monthly premium cashflow paid previously from the policy date till the report generated date). 4. Loan Principal Schedule. 5. Loan Interest Schedule. 6. Cash Wdrl(Gross) Schedule. 7. Cash Wdrl(Net) Schedule. 8. Total. | N/A |

| Wells Fargo Premium Instruction Report (XLSX) | Pay Date, Amount, Client ID, SEI Account, Bank Check Payable Name, Account Number, ABA Number | Start/End Date |

| External Valuation History (CSV & XLSX) | Net Present Value based on previous external valuations: Case Reference, Date, NDB , NPV , Cost Basis, NPV Discount Rate , Aged LE | N/A |

| Insured Obituary Search (HTML) | The report will run in the background. You will receive an email once ready and will be able to find the Report in the Username menu item (demoinvestor, Demo Investor -> My Reports). | N/A |

| Portfolio Summary (PDF) | Table 1: Total Face Amount, Number of Insureds Lives… Table 2: The Min/Avg/Max values for Face Amount, Attained Age, Insured Life Expectancy, Policy Joint Life Expectancy respectively. Table 3: Policy Value for Varias Fees IRR/ Premium IRR/NDB IRR scenarios. | Valuation Template, LE Report Selection, Value Date, Underwriter Weightings… |

| Portfolio Charts (PDF) | 1 . Number of Cases against Face Amount 2 . Face Amount against Face Amount 3 . Number of Cases against Policy Age 4 . Face Amount against Policy Age 5 . Number of Cases against Policy Year 6 . Face Amount against Policy Year 7 . Number of Cases against AMBest Rating 8 . Face Amount against AMBest Rating 9 . Pie chart of Number of Cases by Carrier 10 . Pie chart of Face Amount by Carrier 11 . Number of Cases against Premium Finance 12 . Face Amount against Premium Finance 13 . Number of Cases against State of Ownership 14 . Face Amount against State of Ownership 15 . Number of Insureds against Insured Age 16 . Last Mean LE50 against Age 17 . Number of Cases against Insured Age 18 . Face Amount against Insured Age 19 . Number of Cases against Smoking Status 20 . Face Amount against Smoking Status 21 . Number of Cases against Last LE50 22 . Face Amount against Last LE50 23 . Number of Case against Insured State of Residence 24 . Face Amount against Insured State of Residence | N/A |

| Portfolio Tasks & Follow-ups (CSV) | Serving Tasks, Oder Tracking, Outstanding items only/All items | |

| Premium Payment Instruction (PDF) | Identify the Premium Amount and Date post the defined Start Date (from Premium Schedule): Case Reference, Policy Number, Face Amount, Carrier, Premium Amount, Due Date. | Start Date, Period |

| Rolling XX (CSV) | Identify the Premium cashflow during the XX Months Duration (from Premium Schedule): Case Reference, Policy Number, Face Amount, Carrier, Insured, Monthly Premium Cashflow. | Start Date, XX Months Duration |

| Valuations by Insured (PDF) | Evaluate NDB, Premium/NDB to Maturity and Priced Value under every unique Insured. | Valuation Template, Underwriter Weighting |

| Portfolio Export (XLSX) | Detailed information about the policy, Insured, Underwriter. | N/A |

| Portfolio Import Format (XLSX) | Detailed information about the policy, Insured, Underwriter, Premium Schedule (Monthly). | N/A |

| Premium History VOC Comparison (XLSX) | Premium Amount, Verification Date, Account Information Date, Last Premium Payment Date/Amount | Start/End Date |

| State Reporting (XLSX) | Detailed information about the policy, Insured, Underwriter. | N/A |