Premium Calculator Templates

The ClariNet LS pricing model uses a set of assumptions described as a “Premium Calculator ” to determine how to optimise premium payments for a Policy. When your ClariNet LS account is created, it comes with a default Premium Calculator Template, labelled “Standard Premium Calculator Template” that contains a default set of parameters and values.

Whilst you cannot edit the Standard Premium Calculator Template, you can create your own Premium Calculator Templates and define custom values for the parameters.

Once defined a template can then be used to calculate a Premium Schedule for a Case using the Premium Schedules page. Adding a new Premium Schedule from this page presents three options:

- Use Premium Calculator

- Enter values manually

- Use Illustrated

Selecting Use Premium Calculator allows you to specify which Premium Calculator Template ClariNet LS uses to calculate the Premium Schedule.

In determining a Premium Schedule, ClariNet LS looks at the minimum amounts required to be paid on a periodic basis to keep the Policy in force until its maturity. It uses some of the parameters specified on the Policy tab in this process, such as the Lapse Basis, Maturity Age and Death Benefit Type. The process of determining the Premium Schedule involves calculating the Carrier’s projected COI costs from an illustration – typically based on the table of non-guaranteed values in that illustration – and then determining a stream of premium payments which will keep the Policy in force until the Maturity Date, based on the COI costs and other expenses, while maintaining a specified target Account Value or Cash Surrender Value (depending on the Lapse Basis). A lower target value will reduce the cost of carry for the Policy, but risks needing additional payments if the Carrier increases its COI rates or other expense charges.

Creating and Deleting Premium Calculator Templates

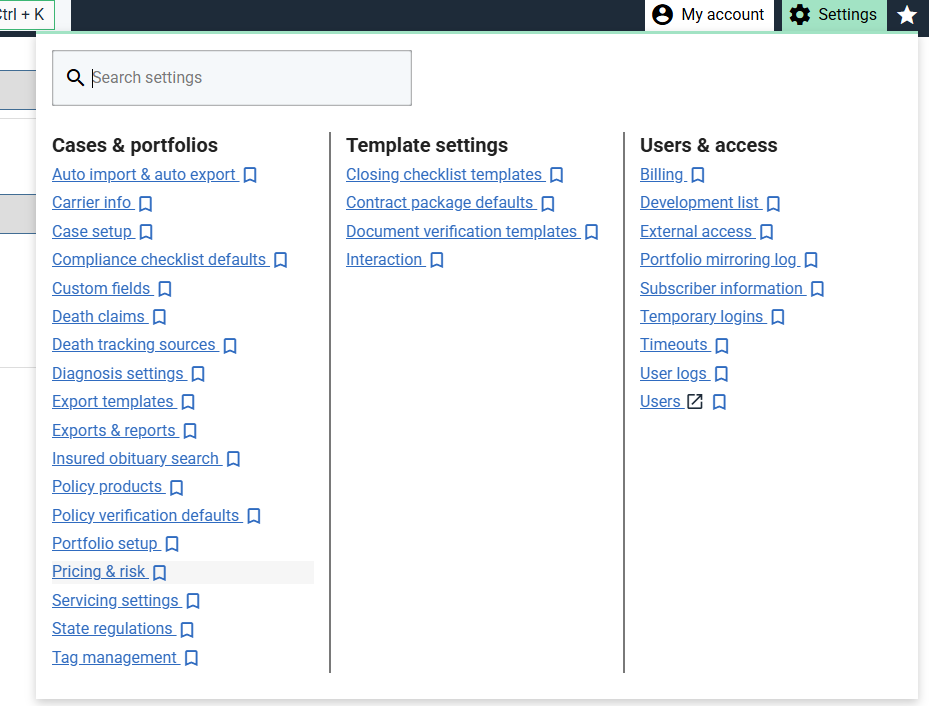

Premium Calculator Templates are managed through the Pricing & risk page under Settings menu > Cases & portfolios > Pricing & risk:

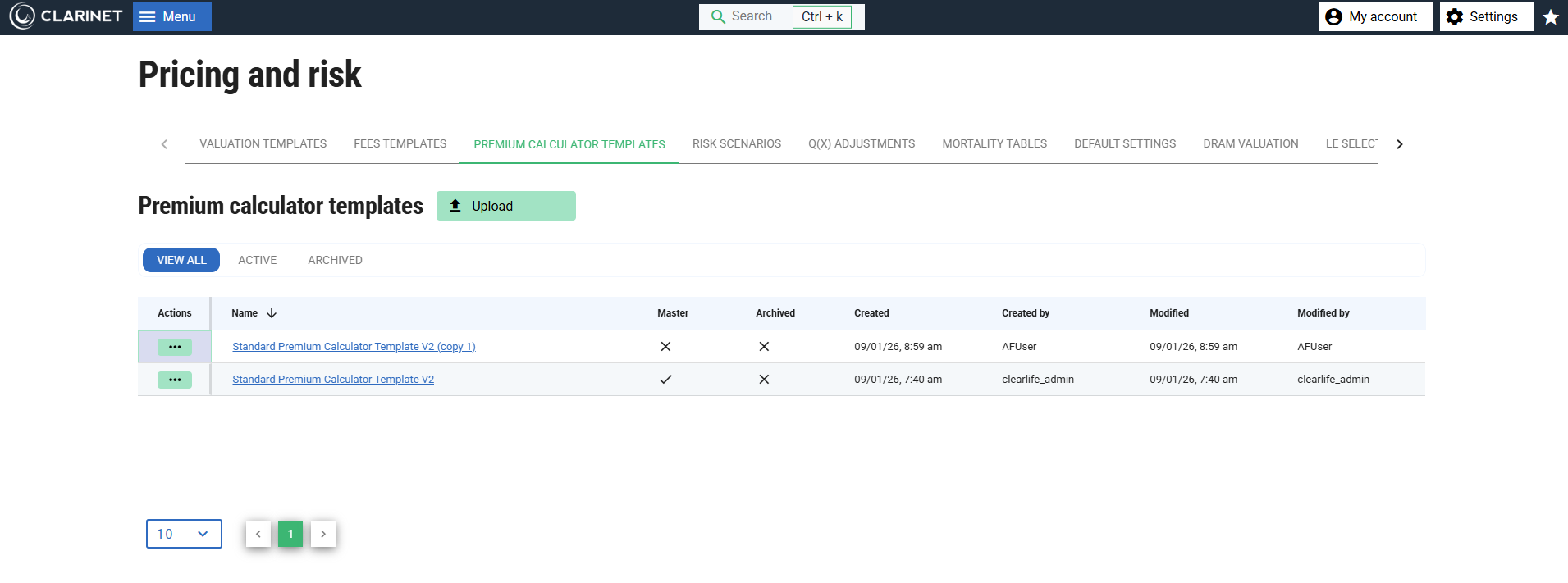

Clicking on the Pricing & risk menu item opens the page. Select the Premium Calculator Templates tab:

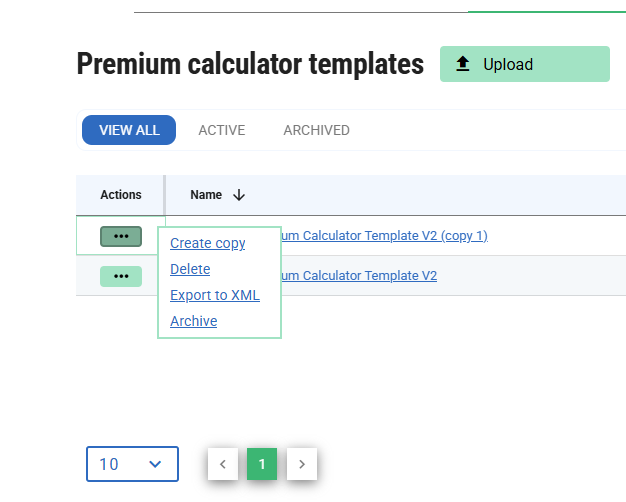

To create a new Premium Calculator Template, click Create a Copy from the action menu.

This creates an identical copy of the selected Premium Calculator Template with the name “<existing_name> (copy 1)”.

The Premium Calculator Template named “Standard Premium Calculator” cannot be deleted or edited. All other Premium Calculator Templates can be deleted or edited at any time, regardless of whether they have been used to generate a Premium Schedule.

Editing a Premium Calculator Template

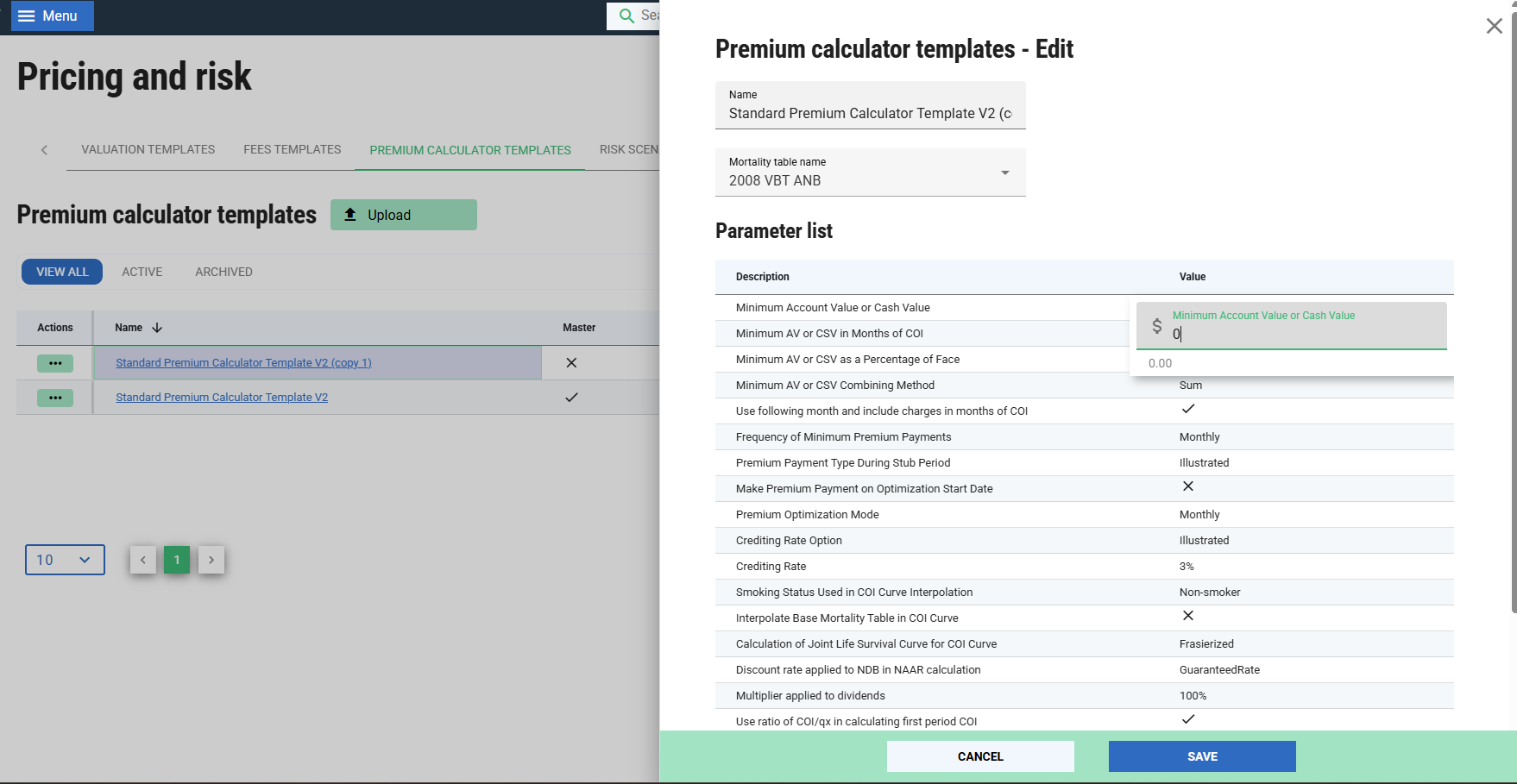

Click on a Premium Calculator Template’s name to open the details slide out. You can edit any non-master Premium Calculator Template.

The top section of the page contains the name of the Premium Calculator Template and a drop-down list of the Mortality Tables which can be attached. The Mortality Table is used to determine the shape of the COI curve which is calculated from an Illustration, where the Illustration table of values stops short of the Maturity Age of the Policy. Below this section is a list of parameters. These describe the construction of a Premium Schedule.

Summary

| Parameter | Description | Example |

|---|---|---|

| Minimum Account Value or Cash Value | Dollar amount of minimum AV/CSV. | $1,000 |

| Minimum AV or CSV in Months of COI | Months of COI (or COI+charges). | 3 |

| Minimum AV or CSV as a Percentage of Face | Percentage of Face Amount to maintain in AV/CSV | 1% |

| Minimum AV or CSV Combining Method | The 3 previous values can be combined as Sum/Min/Max. | Sum |

| Use following month and include charges in months of COI | If True then use next months COI and include charges. | False |

| Frequency of Minimum Premium Payments | Frequency at which payments occur. | Monthly |

| Premium Payment Type During Stub Period | Default premium payment during stub period. | Illustrated |

| Make Premium Payment on Optimization Start Date | Make catchup payment on Start Date. | False |

| Premium Optimization Mode | Frequency at which AV/CSV target it solved. | Monthly |

| Crediting Rate Option | Crediting rate applied to the account value. | Illustrated |

| Crediting Rate | If “Specified” is used above, the rate goes here. | 4% |

| Smoking Status Used in COI Curve Interpolation | Smoking status used to determine actuarial table for COI interpolation. | Non-Smoker |

| Interpolate Base Mortality Table in COI Curve | Mortality table above can be age interpolated. | False |

| Calculation of Joint Life Survival Curve for COI Curve | Methodology used for qx curve in COI interpolation. | Frasierized |

| Discount rate applied to NDB in NAAR Calculation | The formula for NAAR has a discount term, the rate goes here. | Guaranteed |

| Multiplier applied to dividends | The multiplier applied to dividends on whole life policies | 100% |

| Use ratio of COI/qx in calculating first period COI | If true, the ratio COI/qx is extrapolated rather than COI. | True |

| Assume Account Value Date is policy monthiversary | If true, rolls the AV Date to the next policy monthiversary. | False |

| Discount rate used for NLG Optimization | The discount rate when calculating the lowest premiums between NLG and COI payments. | 10% |

| COI Amount calculation version | In ClariNet, the monthly COI rate can be shown in 2 different ways. | V2 |

| Use Ultimate Qx Period | If this box is checked, the q(x) values used for COI curve interpolation will be based on the ultimate period from the actuarial tables, rather than being based on select period 1 on the illustration Account Value Date. | False |

Minimum Account Value or Cash Value

This parameter specifies the target value to be held in Account Value or Cash Surrender Value, expressed as a US dollar amount which is constant over the life of the Policy.

Minimum AV or CSV in Months of COI

This allows you to specify the target value as a number of months’ COI. It will therefore increase over time as COI increases.

Minimum AV or CSV as a Percentage of Face

This specifies the target value as a fixed US dollar amount equal to a percentage of the Face Value which is constant over the life of the Policy.

Minimum AV or CSV Combining Method

If this is set to “Sum”, the target value is calculated as the sum of the three previous parameters. If set to “Maximum”, the target value at the end of each Policy Year is the greater of the three previous parameters.

Use following month and include charges in months of COI

If checked, the following month COI is used and per policy and per unit charges are included in the “months of COI” for the AV/CSV threshold calculation.

If unchecked, the current month COI is used and charges are excluded from the threshold calculation.

Frequency of Minimum Premium Payments

The frequency at which premium payments are to be set in the Premium Schedule. Monthly, Quarterly, Semi-Annual or Annual.

Premium Payment Type During Stub Period

During the period between the Account Value Date (specified on the Illustration or the VOC if one is used) and the Start Date specified for the Premium Schedule, the model will either pay the illustrated premiums, no premiums or an annual amount specified by the User. If this parameter is set to User-specified, then an additional input field will appear on the Premium Calculator page in order to specify the value.

Make Premium Payment on Optimization Start Date

If Premium Payment type during Stub Period is set to a value other than “Illustrated”, then a shortfall can exist in the Account Value or Cash Surrender Value which would make it impossible to maintain the target value at the end of the policy year following the Start Date of the Premium Schedule. To mitigate this risk, checking this box will calculate an extra premium to be paid on the Start Date in order to keep the Policy in force. Note that if this option is combined with Illustrated Premiums or User Specified Premiums during the Stub Period, then the actual amount paid will be calculated from the annualized amount specified and the fraction of the payment frequency between the payment date and the Start Date.

Premium Optimization Mode

This parameter can be set to annual or monthly.

Crediting Rate Option/Crediting Rate

This specifies the Crediting Rate which is to be used in calculating the Premium Schedule. Options are “Illustrated”, “Specified” or “VOC”. “Illustrated” uses the Non-Guaranteed Crediting Rate specified in the Illustration; “VOC” uses the current Non-Guaranteed Crediting Rate specified in the VOC (if selected). “Specified” uses the value set in “Crediting Rate”.

Smoking Status Used in COI Curve Interpolation

If it is necessary to extrapolate the COI curve past the Illustration Maturity Date (e.g., where premiums are payable until a date past the end date of the Illustration table of values), then the Premium Calculator determines a curve shape based on a selected Mortality Table. This then requires parameters similar to the construction of a survival curve from a mean LE50. This parameter governs whether a smoker or non-smoker table is used.

Interpolate Base Mortality Table in COI Curve

Has the same effect as the equivalent parameter in the Valuation Template, with respect to the curve shape for extrapolating COI.

Calculation of Joint Life Survival Curve for COI Curve

Same as for the parameter in the Valuation Template.

Discount rate applied to NDB in NAAR Calculation

The discount rate used to determine the Net Amount At Risk (NAAR) for a given period. Options are the Guaranteed Rate, the Non-Guaranteed Rate or None.

Multiplier applied to dividends on whole life policies

The multiplier specified here is applied to dividends in the illustration. For example, this can be used to multiply by zero if dividends are to be ignored in the minimum premium calculation.

Use ratio of COI/qx in calculating first period COI

If this parameter is true then when the first period COI is negative, the model will take the average ratio of COI/qx in periods 2-4 and use this to calculate the COI in period 1.

Assume Account Value Date is policy monthiversary

If this box is checked, the optimiser assumes that the Initial Account Value/Initial Cash Surrender Value stated in the Illustration is correct as of the Policy monthiversary preceding the Initial Account Value Date.

Discount rate used for NLG Optimization

One of the features of the premium calculator is to determine the most efficient payment schedule when an NLG has been selected. The model will switch from NLG to COI at some point in the future based on the lowest NPV of premium payments. The discount rate used in this NPV calculation is taken from this parameter.

COI Amount calculation version

In ClariNet, the COI can be stated in two ways: V1 and V2. V1 is maintained for backwards compatibility, but V2 is recommended for simplicity. In the equations below: rm: monthly COI rate shown in ClariNet ra: annual COI rate rm2: derived monthly COI rate COI: dollar amount of COI

V1

ra = (1+rm/1000)^12 - 1

rm2 = 1-(1-ra)^(1/12)

COI = rm2/(1-rm2) * NAAR

V2

COI = rm/1000 * NAAR

Use Ultimate Qx Period

If this box is checked, the q(x) values used for COI curve interpolation will be based on the ultimate period from the actuarial tables, rather than being based on select period 1 on the illustration Account Value Date.