Portfolio Generator

The objective of the Portfolio Generator is to simulate the process of buying a new portfolio and managing it over its lifetime. It first models the acquisition of a “model” Portfolio from an existing Portfolio based on a number of parameters. Monte Carlo Simulation is then used to determine the initial cash balance that would be required to maintain that model Portfolio until maturity (i.e. pay premiums, fees and receive NDB payments) and to project out the performance of the model Portfolio over its lifetime.

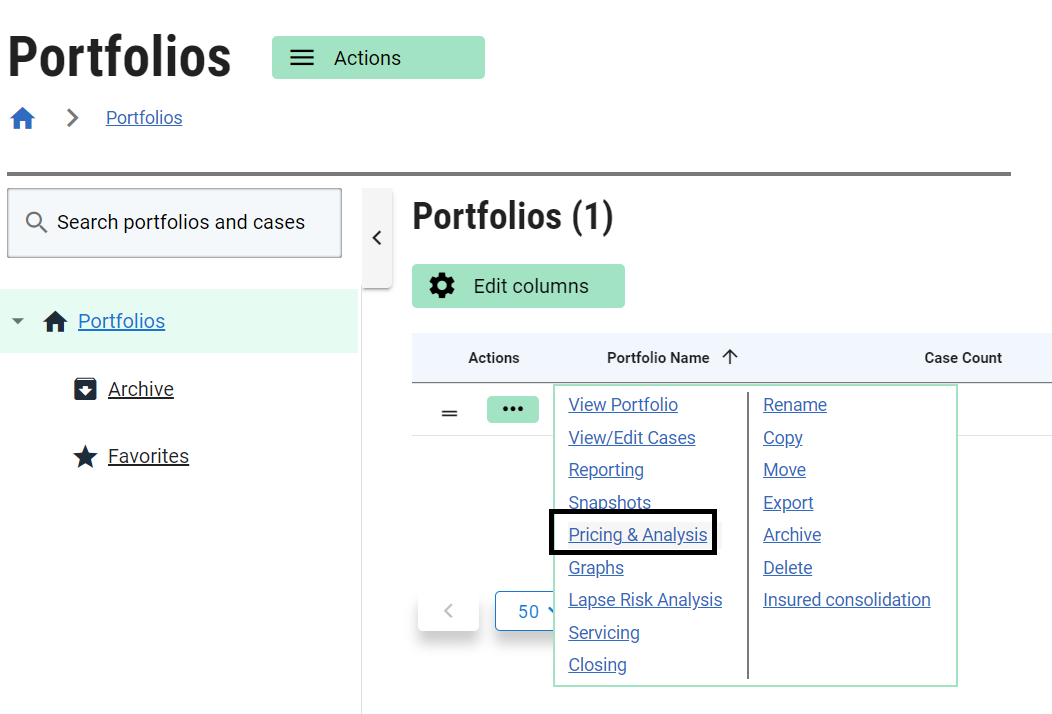

Accessing the Portfolio Generator

The Portfolio Generator is accessed from the Portfolios page (Pricing & Analysis sub menu):

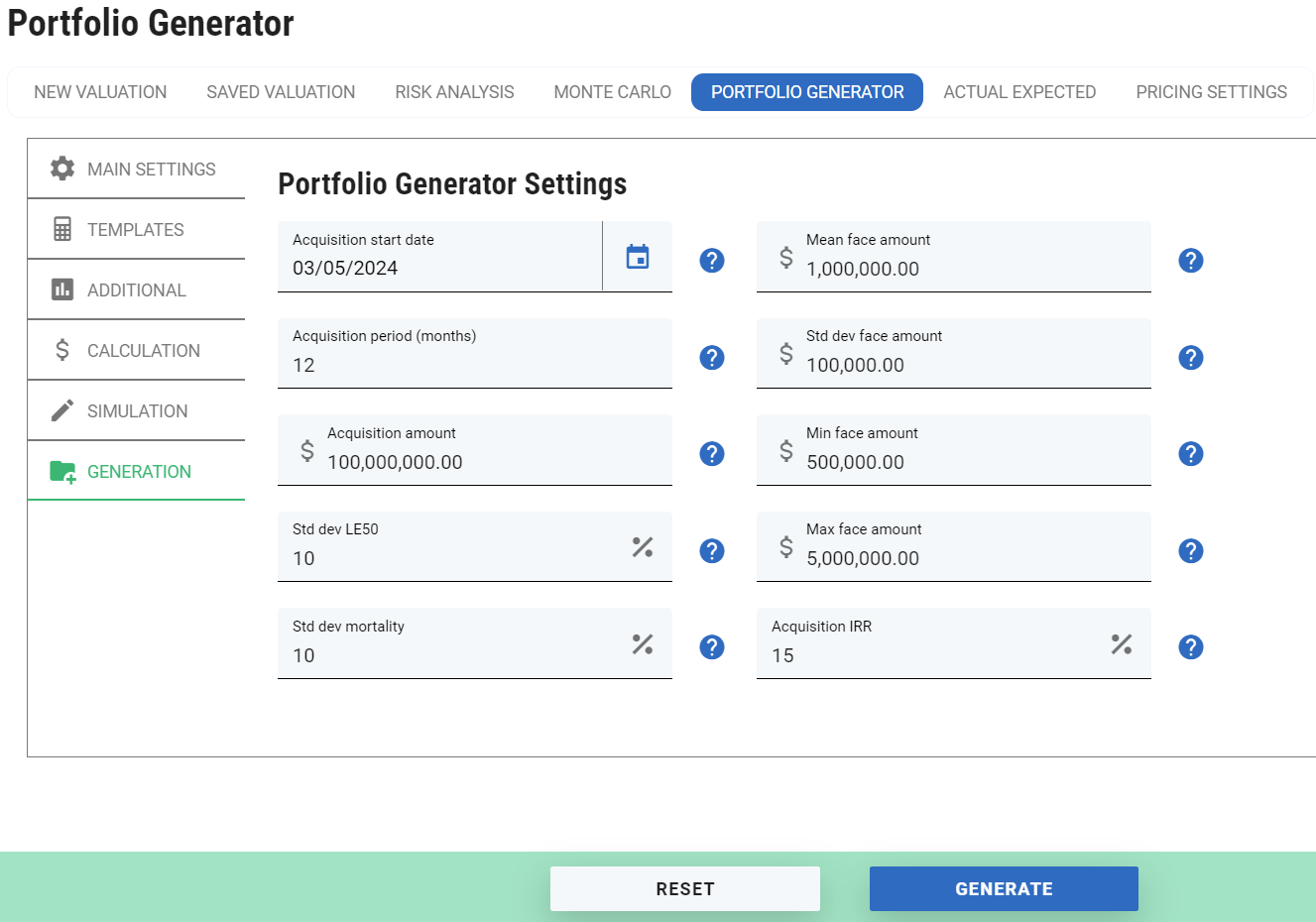

Clicking on the Pricing & Analysis sub-menu for a selected portfolio opens the Pricing & Analysis page. The Parameters are identical to the equivalent sections on the Monte Carlo page. The Generation section - lists the parameters that drive the acquisition modelling:

- Acquisition Start Date: This is the date when the acquisition of the model Portfolio begins, i.e., the first date on which the purchase of a Case completes;

- Acquisition Period (months): The number of months over which the model Portfolio is acquired;

- Acquisition Amount: The USD amount available to purchase Cases (note that this does not include any cash reserve for premiums/fees);

- Std Dev LE50: This parameter is used to modify the LE50 for each model Case (as described under “Generating a Model Case” below);

- Std Dev Mortality Factor: This parameter is used to modify the Mortality Factor for each model Case (as described under “Generating a Model Case” below);

- Mean Face Amount/Std Dev Face Amount: These parameters describe the distribution of Face Amounts for all of the Cases in the model Portfolio;

- Acquisition IRR: The IRR at which each model Case is assumed to be acquired.

Modelling the Acquisition Process

The acquisition process is:

- Select a random case from the sample portfolio;

- Modify the face amount of the acquired case based on the specified mean and standard deviation;

- Modify underwriter reports based on the specified standard deviation of LE50 and Mortality Factor;

- Calculate a Purchase Price using Acquisition IRR;

This is repeated until the total purchase price is equal to the Acquisition Amount.

The Portfolio Generator assumes that the Acquisition Amount is deployed across the entire Acquisition Period, starting on the Acquisition Start Date. The acquisitions are assumed to occur at monthly intervals (a “Monthly Purchase Date”), with an amount equal to (Acquisition Amount/Acquisition Period) being expended on each date. For example, suppose the Acquisition Start Date is set to March 1, 2016 with the Acquisition Period lasting 12 months and an Acquisition Amount of US$120,000,000. In that case, the model will “spend” US$10,000,000 on March 1, 2016, the same again on April 1, 2016, and so on, with the last model Case being purchased on February 1, 2017.

The Portfolio Generator is designed to keep “spending” on each Monthly Purchase Date until the relevant amount is reached. In the ordinary course, this will mean that the monthly amount is exceeded, so once the overall model run is completed, the Portfolio Generator adjusts the Face Amounts and Acquisition Prices down so that the total of all Acquisition Prices for the model Portfolio over the entire Acquisition Period does not exceed the Acquisition Amount.

Generating a Model Case

Each model Case that is acquired is generated by reference to the characteristics of a real Case in the existing Portfolio which is selected at random. Because the real Cases in the existing Portfolio will be “aged” when the Portfolio Generator is run, the process creates new model Cases which are designed to replicate the real Cases. Many of the values from the Real Case are passed unchanged to the Model Case; others are adjusted, as follows:

Face Amount: A Face Amount for the Model Case is randomly selected from a distribution which is defined by the Mean, Standard Deviation, Min and Max values specified in the Portfolio Generator section. Real Case (example): US$2,500,000

Policy Date: The Policy Date is shifted forward by a number of days based on the difference between the Purchase Date of the Real Case and the Monthly Purchase Date associated with the Model Case. Real Case (example): May 15, 2005

Premium Schedule: Compare the Face Amount of the Model Case to the Face Amount of the Real Case and adjust the Premium Schedule pro rata. Real Case (example): Monthly payments

Insured Date of Birth: The Date of Birth is shifted forward by a number of days based on the difference between the Purchase Date of the Real Case and the Monthly Purchase Date associated with the Model Case. Real Case (example): April 15, 1931

Number of LE Reports per Insured: The same number of LE Reports are generated for each Insured in the Model Case. Real Case (example): Two

LE Report Dates: The LE Report Dates are adjusted forward so that they are the same number of days prior to the relevant Monthly Purchase Date as the real LE Reports are in relation to the Purchase Date for the Real Case. If the LE Reports for the Real Case post-date the Purchase Date for the Real Case, the LE Reports for the Model Case are rolled back to the Monthly Purchase Date so they are extant as of purchase. Real Case (example): Feb 15, 2013

LE50: A random number based on an assumed normal distribution with the LE50 of the LE report associated with the Real Case as the mean value and a standard deviation as set out in the Portfolio Generator parameters. Real Case (example): 60 months

Mortality Factor: A random number based on an assumed normal distribution with the mortality factor stated in the LE report associated with the Real Case as the mean value and a standard deviation as set out in the Portfolio Generator parameters. Real Case (example): 150%

Because the LE50 and the Mortality Factor are calculated independently for each LE Report, they will not change in line with each other. It is therefore possible that the LE Reports for a Model Case will have LE50s and Mortality Factors which would be inconsistent in the real world (e.g., a very high Mortality Factor and a very long LE50). Keeping the St Dev parameters low will reduce the variability. As a matter of practice, the inconsistency will not be a concern because only one of these two parameters is used in any Valuation Template, not both.

Generating the Purchase Price for a Model Case

Once the parameters for the Model Case are determined, the Purchase Price is calculated by discounting the NDB and Premium cashflows back to the relevant Monthly Acquisition Date at a discount rate equal to the Acquisition IRR.

Outputs

In addition to the regular output files generated by the Monte Carlo process; the Portfolio Generator produces the following reports:

Cumulative Cashflows: This shows the total cumulative cash paid or received in the course of each simulation. The minimum amount shown represents the amount of the cash required as a reserve at the start of the acquisition process (assuming that no interest is paid on the cash reserve).

Portfolio Importer Format (XLSX): This sets out details of the model Cases in the model Portfolio. As the Portfolio Generator does not save this information, exporting this file is the only way to review the details of the model Portfolio. Note that it is possible to replicate the model Portfolio by changing the Random Seed to an integer other than zero, which will then produce the same series of random numbers.

Note that the Per Simulation Results – which include the NPV and IRR for each simulation run – require that the “Calculate Realized IRR” box be checked in the Valuation Parameters section.

The Distribution Analysis report provides an excellent summary of the expected cashflows and shows the amount of Premium Reserve required at each confidence level.