Risk Scenarios

Overview

Risk Scenarios can be used during Policy and Portfolio Valuation to calculate policy values changes resulting from changes to inputs.

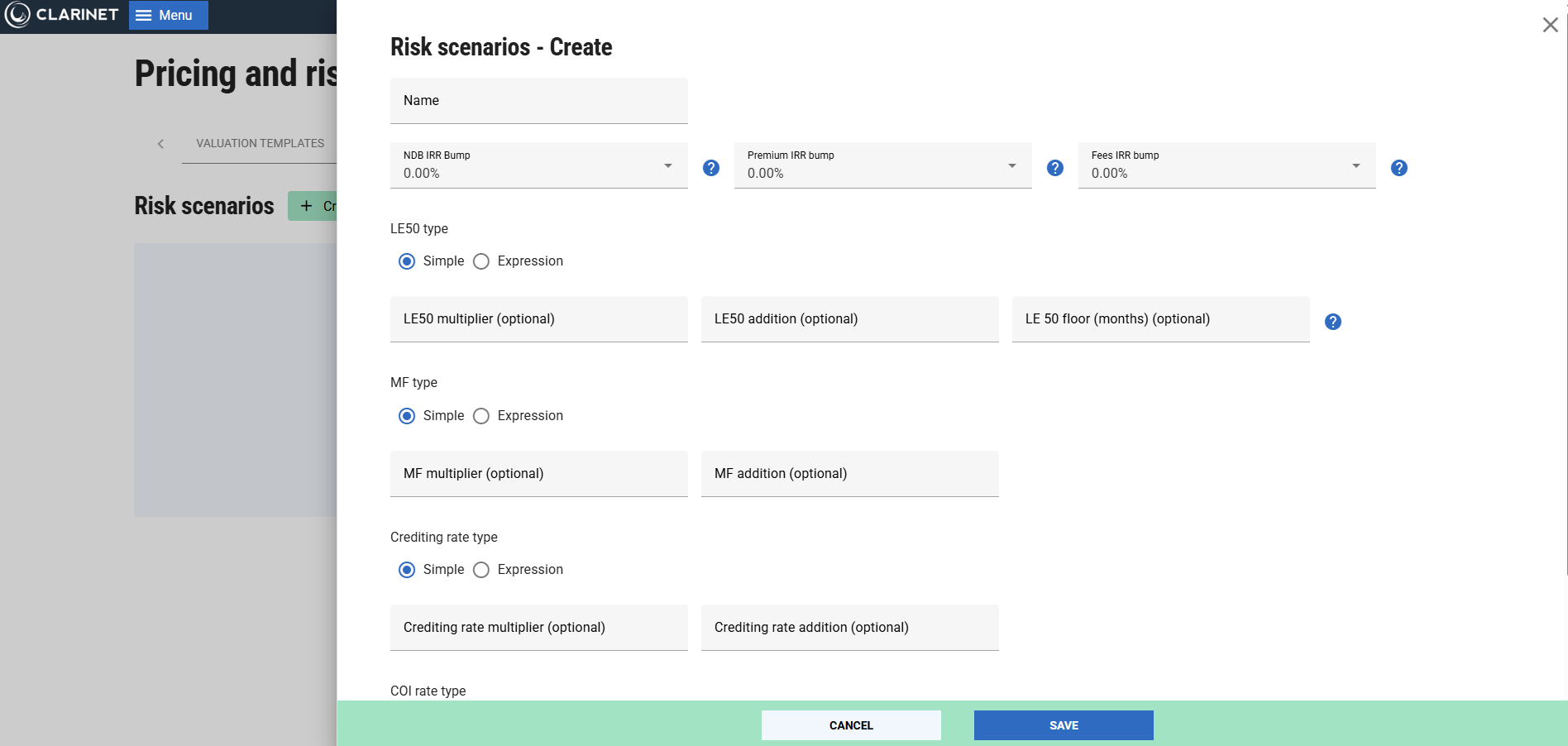

Adding a Risk Scenario

Types of Risk Scenarios

- IRR Bumps (%): the IRR used for discounting the 3 cashflow legs can be bumped by the specified amount;

- LE50 Multiplier/Addition: the Mean LE50 of any LE Reports used in the valuation can be adjusted by the specified amount. For example if the input Mean LE50 is 80 months and you specify a multiplier of “1.5”, the LE50 will become 120 months. If you specify an addition of “12”, it will become 92;

- MF Multiplier/Addition: the Mortality Multiplier will be adjusted according to the same methodology as the LE50;

- (Crediting Rate Multiplier): not currently used. This is likely to be removed in a future release of ClariNet;

- (COI Rate Multiplier): not currently used. This is likely to be removed in a future release of ClariNet;

- Premium Multiplier: the premium amount is multiplied by the specified factor;

- LE Date Shift Type: the Report Date of an LE Report can be modified. See below.

Pricing Expressions

Note that for some of the risk scenario types, it’s possible to specify an Expression rather that a simple value. Please refer to this page for details of how these work.

LE Date Shift Type Scenarios

There are 4 ways to modify the Report Date.

- Specified Date: the LE Report Date is altered to the specified date;

- Specified Shift Relative to Existing Date: the LE Report Date is altered using the specified shift relative to the actual date of the report For example if the LE Report Date is 1-jan-2023 and a shift of “1Y” is specified then it will be moved to 1-jan-2024. A negative shift can also be specified;

- Specified Shift Relative to Value Date: the LE Report Date is altered to a date relative to Value Date. For example if a shift of “-1Y” is specified and Value Date is 1-jan-2025, the Report Date will be set to 1-jan-2024.

- Value Date: the LE Report Date is set to Value Date.