Lump Sum Payments in Premium Calculator

There are pricing scenarios where the buyer of a policy requires the seller to make a lump sum premium payment, for example to increase the account value such that there is no risk of the policy going into grace.

Comparison

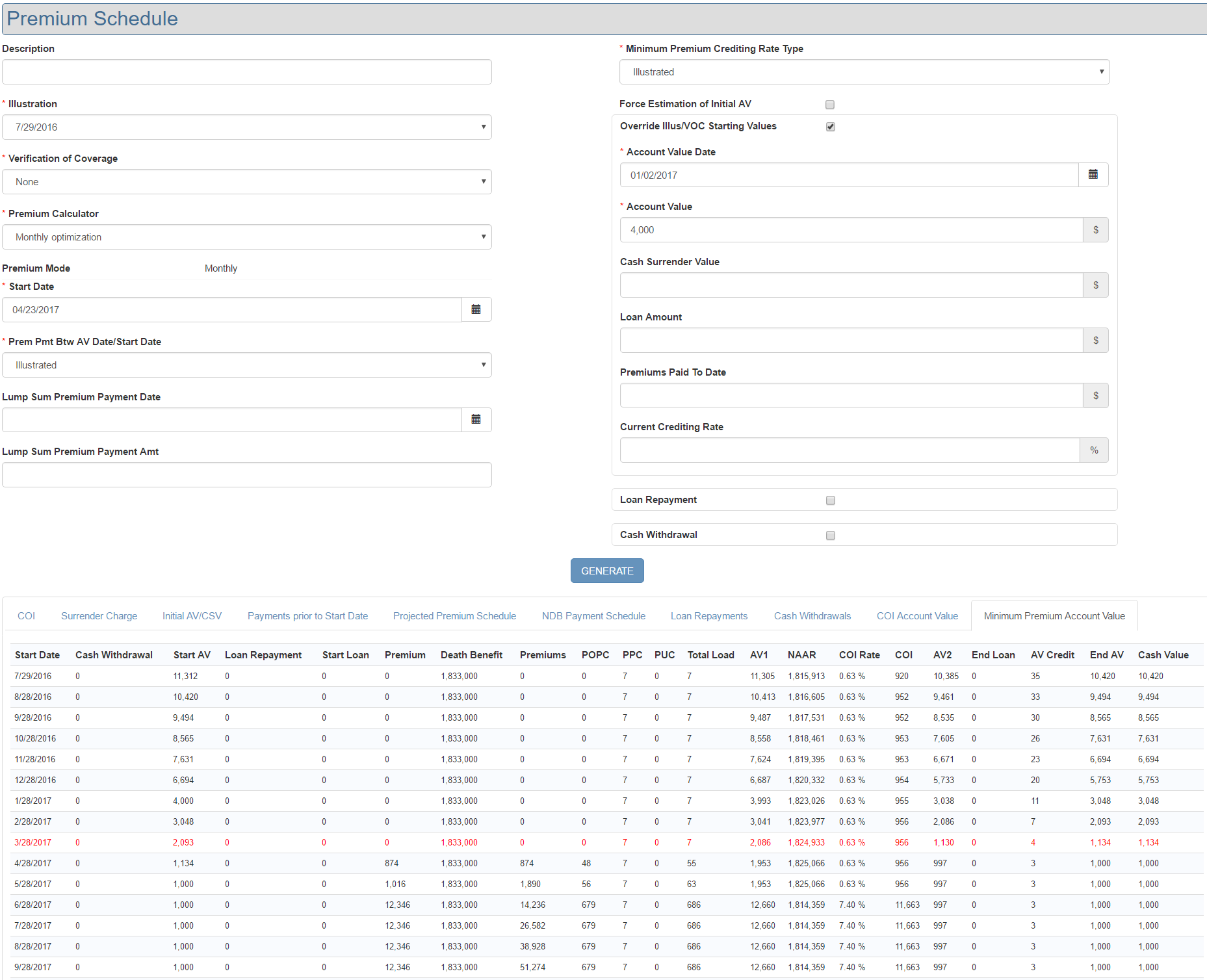

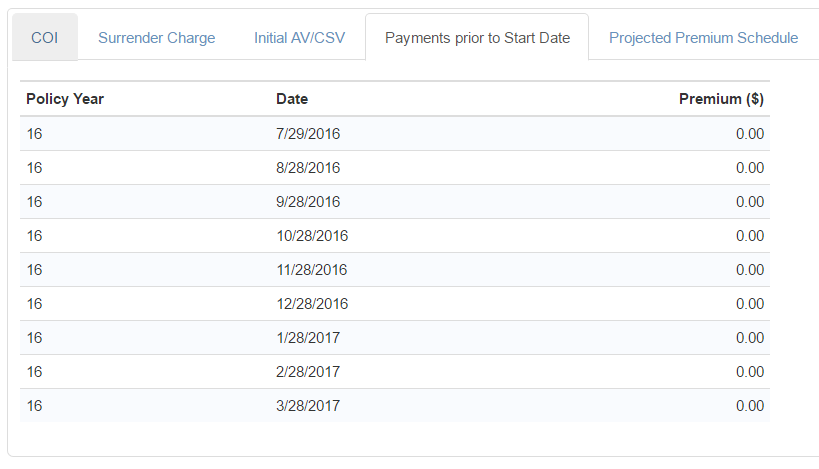

Without Lump Sum Payment

In this example, we have a VOC dated 2-Jan-2017. The purchase date of 23-April-2017, implies an immediate payment of $874 to keep the policy above our $1,000 threshold. You can see there are no payments prior to Start Date:

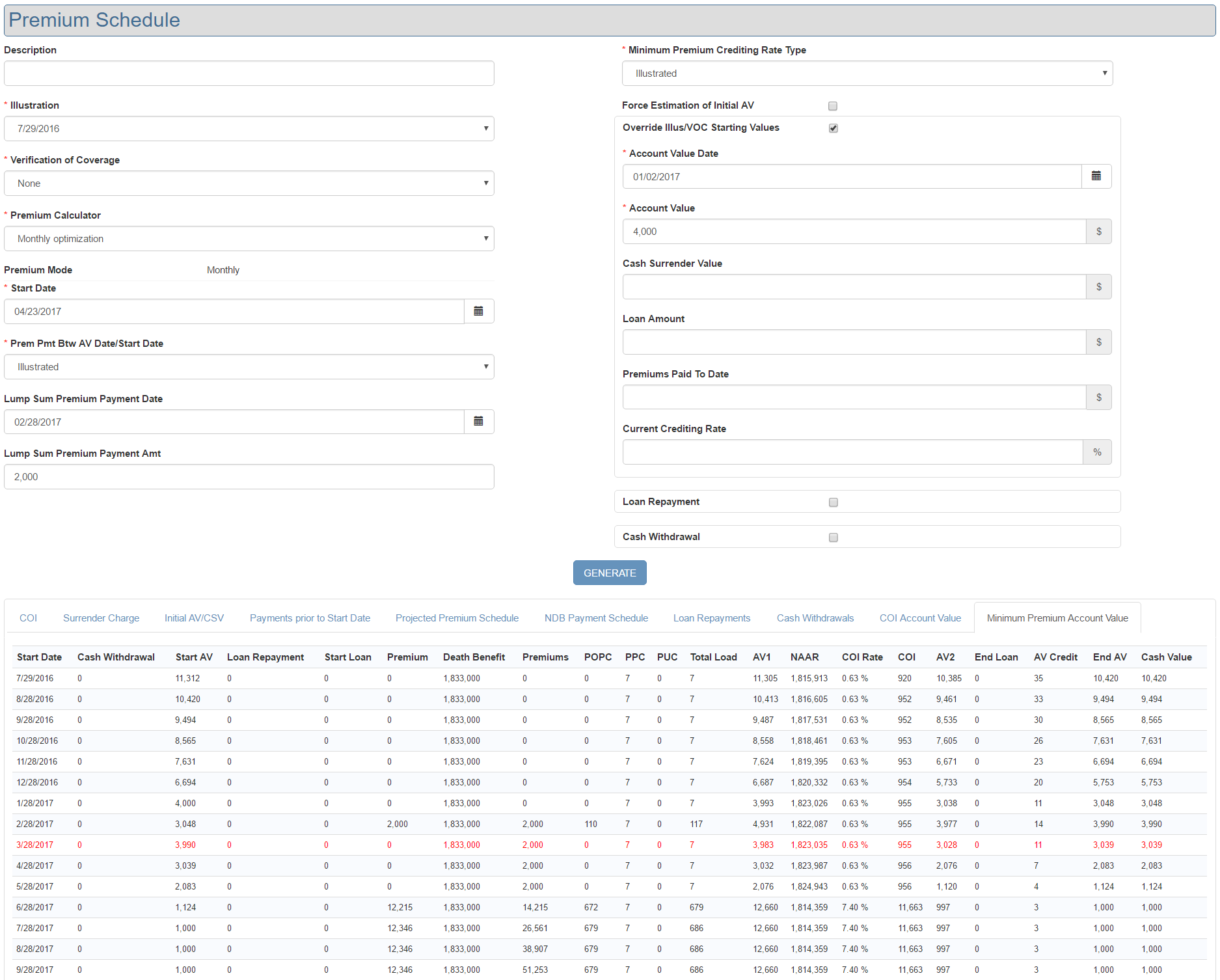

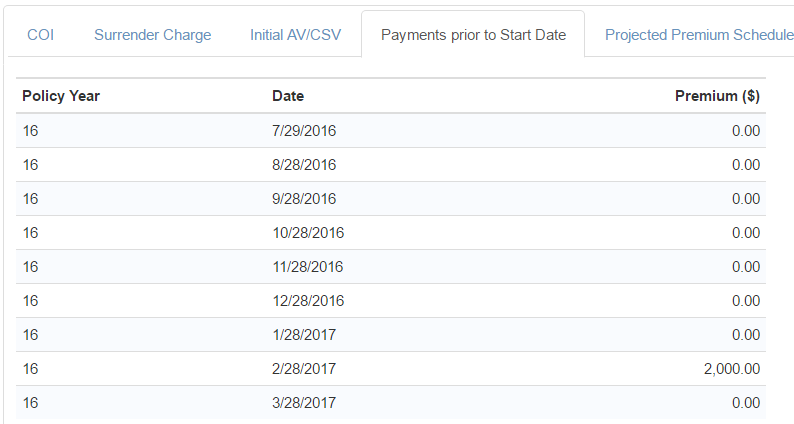

With Lump Sum Payment

Here, we’ve added a lump sum payment on 28-Feb-2017 of $2,000. This removes the following two premium payments and slightly reduces the following payments. The lump sum payment is noted in the payments prior to Start Date:

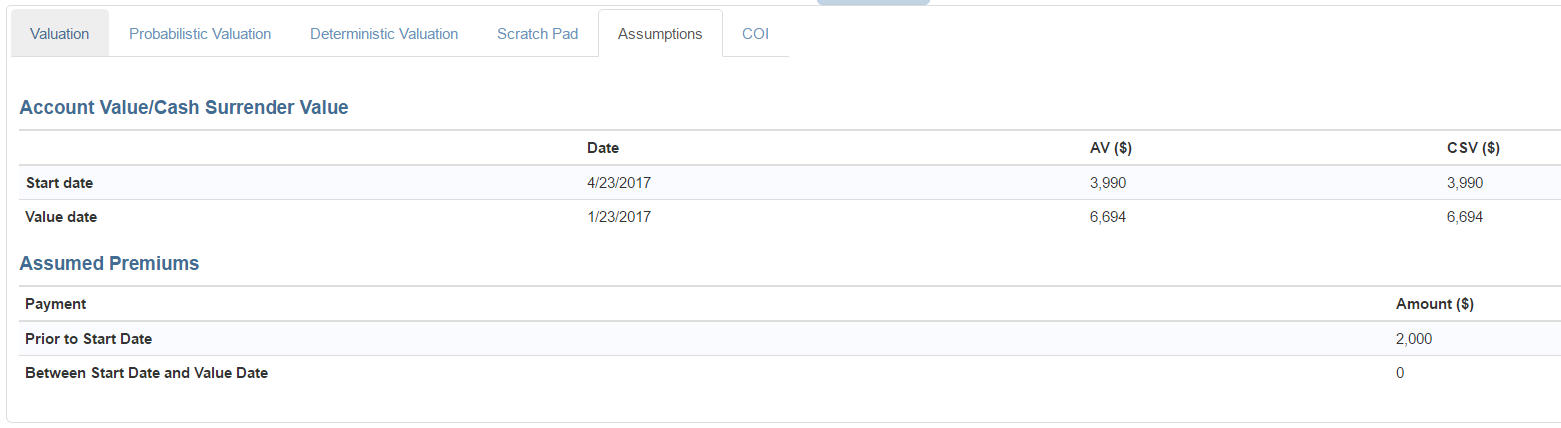

Since the lump sum payment is before Start Date, it will not be included in the premium schedule and will therefore not be part of the NPV calculation. It is shown in the assumptions tab of the single policy valuation page:

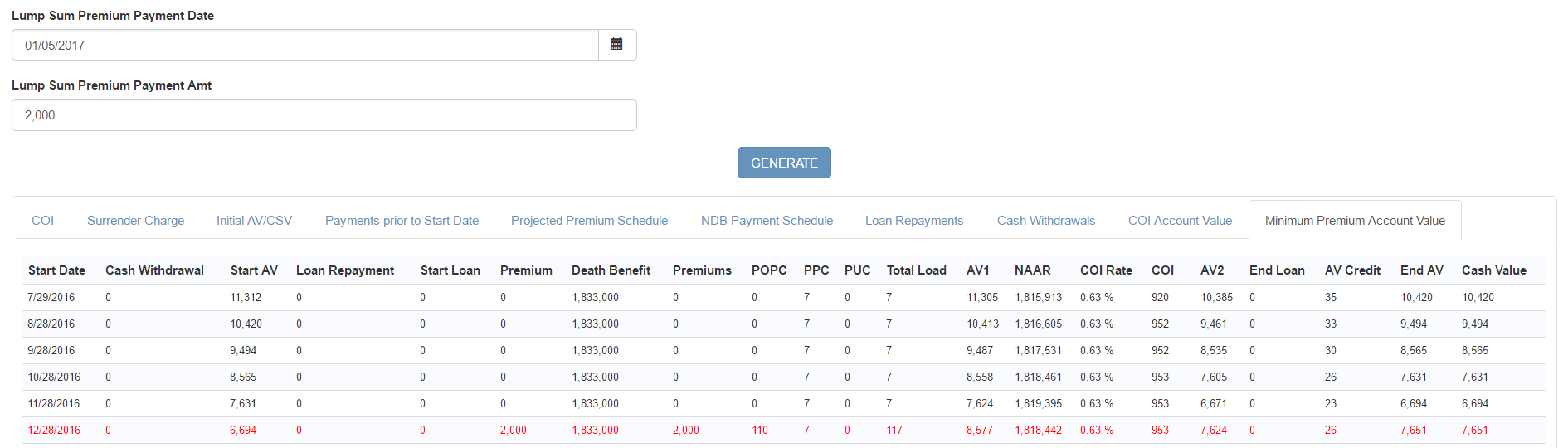

Lump Sum Payment Date

The lump sum payment will be applied on the policy monthiversary at the start of the period in which it is specified. For example, here we have specified a lump sum payment date of 5-Jan-2017:

The payment has been applied on 28-Dec-2016. If this is an issue, it may be simpler to specify lump sum payments on policy monthiversaries.