Valuation Template Parameters

Summary

| Parameter | Description | Example |

|---|---|---|

| Improvement Rates | A set of improvement rates which will be applied to qx values. | 0% |

| Survival Factor Interpolation Type | Specifies how qx⇒sp. | Piecewise Constant Qx |

| Interpolate VBT Table Row Based on DOB at LE Review Date | Determines whether age is interpolated between table rows. | False |

| Calculation of Joint Life Survival Curve | Specified how two sp values are combined for a JL policy. | Frasierized |

| Smoking Status Override | Disambiguates conflicting smoking statuses. (*) | Non smoker |

| LE Calculation Type | Determines whether to use mean or median LE50. (*) | Mean |

| Calculation of LE Review Date Given Multiple Reports | When combining LE reports, determines which underwriting date is used. (*) | Newest |

| NDB Collection Lag | Specifies the lag between insured death and NDB cashflows. | 3M |

| IRRs | Specifies the discount rate when NPV is calculated. | X%/X%/X% |

| Base Scenario | When calculating risks scenarios, this specifies which discount rate set is used. | 1 |

| Interest payment during NDB collection lag | NDB payments can be accrued up during lag until carrier payment. Can be None, GCR or User Specified. | None |

| User-defined NDB collection lag interest rate | If the parameter above is specified as User Specified, the rate goes here. | 5% |

| Use Fasano Tables if Available | If an LE report is Fasano, and specification of table is ignored and the Fasano table will be used for this report if the user has permission to access the Fasano tables. | True |

| Aging underwriter reports | Specifies how reports are aged from report date to value date. (*) | Regular |

| Improvement Start Type | Specifies when table improvement begins. | TableStartDate |

| Blending methodology when combining life expectancy reports | Lx/ Mqx/ MeanLE50/ MortalityFactor. This specifies how multiple reports are blended. | Lx |

| Longevity Calculation Type | Specifies some details of qx⇒sp calculation. | Exact |

| Apply Improvement Rate Before Mortality Calculation | Specifies whether the improvement rate is used during calculation of implied mortality factor. | True |

| Value Date Shift Type | This parameter will shift the value date to a policy monthiversary. | None |

| Set LE Report Date(s) to Policy monthiversary | Shift the LE report date to be on a policy monthiversary. | False |

| Include Other Purchase Costs In IRR | When calculating IRR, the Other Costs specified in the Cost/Maturity/Disposal tab can be considered in the calculation. | False |

| Include Origination Fee In IRR | As in the previous parameter, specify here whether the Origination Fee is included. | True |

| Subtract the specified number from the Mean LE50 | A global number of months to subtract from LE50 values when they are used in calculations. | 0 |

| Exclude Paid Premiums In Portfolio Valuation | When a paid premium is specified it can be subtracted from projected premiums if this parameter is true. | False |

| Use Previous Month NDB When Calculating Expected Cashflows | Some pricing models use the previous month NDB when calculating expected cashflows. | False |

| Premium Payment Day Of Month | All premiums can be shifted to a specified date in the month | Do not shift |

| Premium Payment Month Shift | If the previous parameter has a value other than “Do not Shift”, this parameter determines how they are shifted. | Following |

| NPV Cap | The NPV of this case will be capped at the specified %age of NDB. | |

| Premium Payment on Value Date | The first premium payment after Value Date will be paid on Value Date. | False |

| Simplify Survival Rate Calculation | When building the survival curve, all dates are assumed to be monthly, policy date is ignored. | False |

Improvement Rates

The first six parameters detail mortality improvements to be applied in calculating the survival curve for an Insured. The pricing model draws the mortality rate from the chosen Mortality Table and then applies an improvement rate to that mortality rate to mimic increasing longevity in the general population. The improvement rate can differ by gender and smoking status and is a constant annual rate.

By way of example, if you specify an improvement rate of 1.00% for male non-smokers, then for any Insureds who fall into that category, the periodic annual mortality rate for a given year will be reduced by a factor of (1-0.01)^n, where n is the number of years between that year and the starting point for mortality improvement. For further details on this calculation, please see “ImprovementRates.xlsx”.

If the parameter Improvement Start Type is set to TableStartDate then the pricing model assumes that mortality improvement is applied from the inception date of the selected Mortality Table (e.g., 1 January 2015 for the 2015 VBT). See that parameter for details of other options.

Survival Factor Interpolation Type

When the survival probability curve is constructed, a survival factor is calculated at each policy payment date. In most situations, these data points are used in calculating survival rates (e.g. in valuing a policy, the curve is used on these data points). However, it is also necessary to calculate the survival factor between policy payment dates (e.g. when computing a median LE). In order to do this, we need to interpolate between two survival factors. There are four options available:

- Piecewise Constant Qx;

- Piecewise Constant Force of Death;

- Piecewise Linear Qx; and

- Piecewise Linear Force of Death.

If either Qx option is selected, then we interpolate the mortality rate. If either Force Of Death option is selected, then we calculate a force of death and we assume that the survival factor is calculated using a continuously compounded force of death. For information on the calculations involved in choosing Piecewise Constant versus Piecewise Linear, please review the FAQ entitled “Interpolation of Mortality Curves”.

Interpolate VBT Table Row Based on DOB at LE Review Date

When the mortality rate is calculated from the Mortality Table, a row must be selected based on the age of the Insured at the relevant LE Report Date. If this box is checked, then, assuming the LE Report Date is not on the Insured’s birthday, we take the row for their last birthday age and their next birthday age and compute an interpolated row. This is done by linearly interpolating the VBT values between the two rows. If this box is not checked, then the row will be selected based on the Age Basis of the Mortality Table specified in the Valuation Template.

Calculation of Joint Life Survival Curve

This describes how a joint life survival curve is expressed for Policies with two surviving Insureds. Options are:

- Average: blend the two Insured survival curves with equal weighting to each;

- Frasierized: use joint probability to determine the survival curve;

- Oldest: use the survival curve for the older Insured; and

- Youngest: use the survival curve for the younger Insured.

The formulae for Frasierized are:

Survivorship Policy: 1-[(1-sp_primary)*(1-sp_secondary)]

First to Die Policy: 1-[(1-sp_primary)+(1-sp_secondary)-(1-sp_primary)*(1-sp_secondary)]

Smoking Status Override*

The pricing model uses the smoking status allocated to an Insured in a LE Report to determine which version of the Mortality Table it should select (Smoking or Non-Smoking). Occasionally, different underwriters will disagree about the smoking status (because they use different criteria). In this case, you need to make a determination one way or the other, which is done with this parameter.

LE Calculation Type*

This parameter is used in calculating the life expectancy – it determines which of the values specified in a given LE Report is used to drive the creation of the survival curve. If “Median” is chosen, the life expectancy is calculated by searching along the curve for the specified survival factor (50% in the case of LE50) and looking up the number of months where that rate is found. In practice, the exact survival rate will not exist on the curve so we find the survival rate either side of the specified value and interpolate the date. If “Mean” is chosen (this is what some people call “Actuarial”), then the expected value is computed. This calculation consists of multiplying all the survival rates on the curve by the number of months at which that survival rate occurs and summing these values.

Calculation of LE Review Date given multiple Reports*

Where more than one LE Report is used to generate the survival curve for an Insured, parameters from each LE Report are blended to build a blended survival curve. The blended survival curve is determined by reference to a blended “LE Report Date”, which is set to one of:

- Blended: The weighted average of the LE Report Dates;

- Newest: The most recent LE Report Date; and

- Oldest: The oldest LE Report Date.

NDB Collection Lag in Months

When calculating the net present value of the Policy, Net Death Benefit receipts are assumed to be received this number of months after the death of the Insured.

Scenarios and IRRs

Each Valuation Template accommodates up to three different Valuation Scenarios, which are combinations of discount rates applied separately to each of the three cashflow streams associated with a Policy (Fees, Premiums and Net Death Benefit). The discount rate used to present value each stream can be the same in any one Valuation Scenario, or different.

Base Scenario

The Scenario which is used by default when valuing a Portfolio using the Valuation Template (as Portfolio valuation only uses one set of discount rates).

Interest payment during NDB collection lag

This specifies the interest which is assumed to accrue on the Net Death Benefit from Policy maturity to the assumed date of payment. Options are:

- None: Assume no interest is credited during the period;

- NGCR: Assume interest is credited at the then current Non-Guaranteed Crediting Rate.

- User Specified: Assume interest is credited at a user-defined rate.

User defined NDB collection lag interest rate

Relevant if “User Specified” is selected for the parameter above, otherwise ignored.

Use Fasano Tables if Available

If your subscription includes access to the mortality table produced by Fasano Associates, checking this box will connect that table with the Valuation Template.

Aging Underwriter Reports*

- Before Blending

- Regular

- Straight

- Roll down

Regular/Before Blending

When Before Blending is checked, this ages each selected LE Report through to the newest LE Report Date and then calculates implied mortality factors from that point. Note that this will ignore the “Calculation of LE review date given multiple reports” setting as older LE Reports will always be moved forward to the newest LE Report Date. The implied mortality factor for each LE Report is therefore calculated on this newest LE Report Date, rather than being calculated as of its LE Report Date.

By way of example, assume that you have a Case with two underwriter reports – each at a 50% weighting - and a Value Date of January 9, 2016 and you have “Calculation of LE review date given multiple reports” set to “Oldest”:

- UW1 Report dated January 1, 2015, LE50 100 months

- UW2 Report dated January 1, 2016, LE50 90 months

Now – if Aging Underwriter Reports is set to Regular:

Calculate implied MF1 for UW1 Report as of UW1 Report Date of January 1, 2015 (assume 150%);

Calculate implied MF2 for UW2 Report as of UW2 Report Date of January 1, 2016 (assume 120%);

Combined implied MF = 135% as of January 1, ; and

2015

The survival calculation as of the Value Date will age from (giving just over one year of selection).

January 1, 2015

If Aging Underwriter Reports is set to Before Blending:

Calculate implied MF1 for UW1 Report as of UW1 Report Date of January 1, 2015 (assume 150%);

Age UW1 Report forward to UW2 Report Date (note that this uses the same “curve re-entry” as for Independent Ageing, thus it will result in a shorter LE50 for as of UW2 Report Date);

Recalculate implied MF1 for UW1 Report as of of January 1, 2016 (assume 170%);

aged

UW2 Report Date

Calculate implied MF2 for UW2 Report as of UW2 Report Date of January 1, 2016 (assume 120%);

Combined implied MF = 145% as of January 1, and

2016;

The survival calculation as of the Value Date will age from (thus next to no selection).

January 1, 2016

Straight

The LE50 in the report is decreased by the number of full months between the LE Report Date and Value Date.

Roll Down

Improvement Start Type

- TableStartDate: improvement is applied from the table start date (e.g. 1/1/2015 for 2015 VBT).

- UnderwritingDate: improvement applies from underwriting date.

- UnderwritingDateWithExtraYear: improvement applies from underwriting date but a year of improvement is added.

Blending methodology when combining life expectancy reports

This parameter describes the process by which information from individual LE reports is combined to generate a survival curve for each Insured. Options are:

- Lx: Calculate an implied mortality factor for each LE report (or take the value specified in the LE report) and build a survival probability curve on Value Date. Calculate a weighted average lx from the individual curves to give a final survival probability curve;

- MeanLE50: Take the mean LE50 specified in the report (or calculate it if a mortality factor has been specified). Calculate the weighted average and generate an mqx curve on the blended underwriting date;

- MortalityFactor: Calculate the mortality factor for each underwriter report (or take the value specified in the report). Calculate the weighted average and generate an mqx curve on the blended underwriting date; and

- Mqx: calculate a mortality factor for each report (or take the value specified in the report) and build an mqx curve on Underwriting Date. Build a new curve from Value Date, calculating a weighted average mqx from the individual curves.

Note that if you select either Lx or Mqx, some of the parameters in the Valuation Template are ignored:

- Smoking Status Override: Ignored, as the Mortality Curve used for each LE Report is selected based on the values in that LE Report;

- LE Calculation Type: Ignored, as the setting is made independently for each LE Report;

- Calculation of LE review date given multiple reports: Ignored, as a survival curve is calculated from each selected LE Report Date; and

- Age Underwriter Reports before blending: Ignored, as there is no implied mortality factor blending done with independent ageing.

Longevity Calculation Type

This parameter specifies how ClariNet calculates the survival probability from the mortality rates and how those survival rates are used in calculating Net Death Benefit payments. The options are:

Apply Improvement Rate Before Mortality Factor Calculation

This checkbox changes the way that the implied mortality factor is calculated (when using a blending methodology other than "MortalityFactor"). If checked, it applies the Improvement Rates specified in the Valuation Template to the selected Mortality Table before solving for the implied mortality factor. This will result in an increase to the implied mortality factor, for a given LE, which will be reversed out when calculating the survival curve - as the improvement rate will also be applied to the table when calculating the survival curve. If unchecked, no improvement is applied when solving for the implied mortality factor, which will result in a lower implied mortality factor and - if a positive Improvement Rate is specified - a longer mean LE when generating the survival curve.

Value Date Shift Type

- None

- Next: the model will assume that the Value Date is on the following Policy Monthiversary even if this moves Value Date to the next month.

- ThisMonth: the model will assume that the Value Date is on the Policy Monthiversary in the same month as Value Date. This may result in the Value Date being shifted backwards.

This parameter applies in both a single policy pricing and portfolio pricing context

If Next or ThisMonth is specified, this will result in there being no "stub period" at the start of the survival probability curve between Value Date and the following policy monthiversary. Survival probability is equal to 1 on the following monthiversary if this box is checked. This setting is useful for comparing ClariNet to other models.

Set LE Report Date(s) to Policy Monthiversary

If this box is checked, the model assumes that LE reports are dated on the policy monthiverary in the month when the report is actually dated. This results in mqx rates or survival probability curves being on the same schedule as the policy cashflows. This setting is useful for comparing ClariNet to other models.

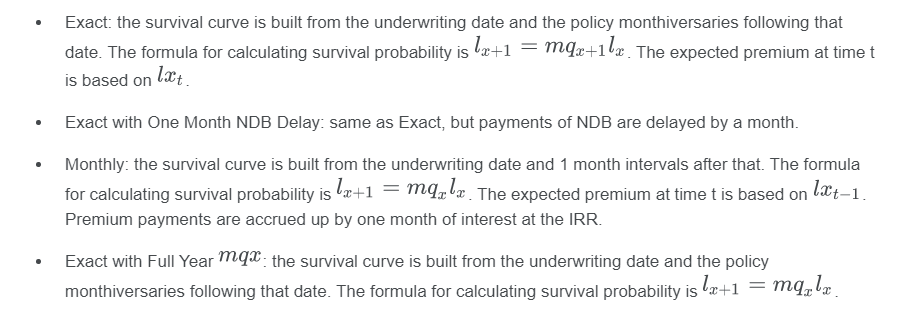

Include Other Purchase Costs In IRR

When calculating IRR, the Other Costs specified in the Cost/Maturity/Disposal tab can be considered in the calculation. The value comes from here:

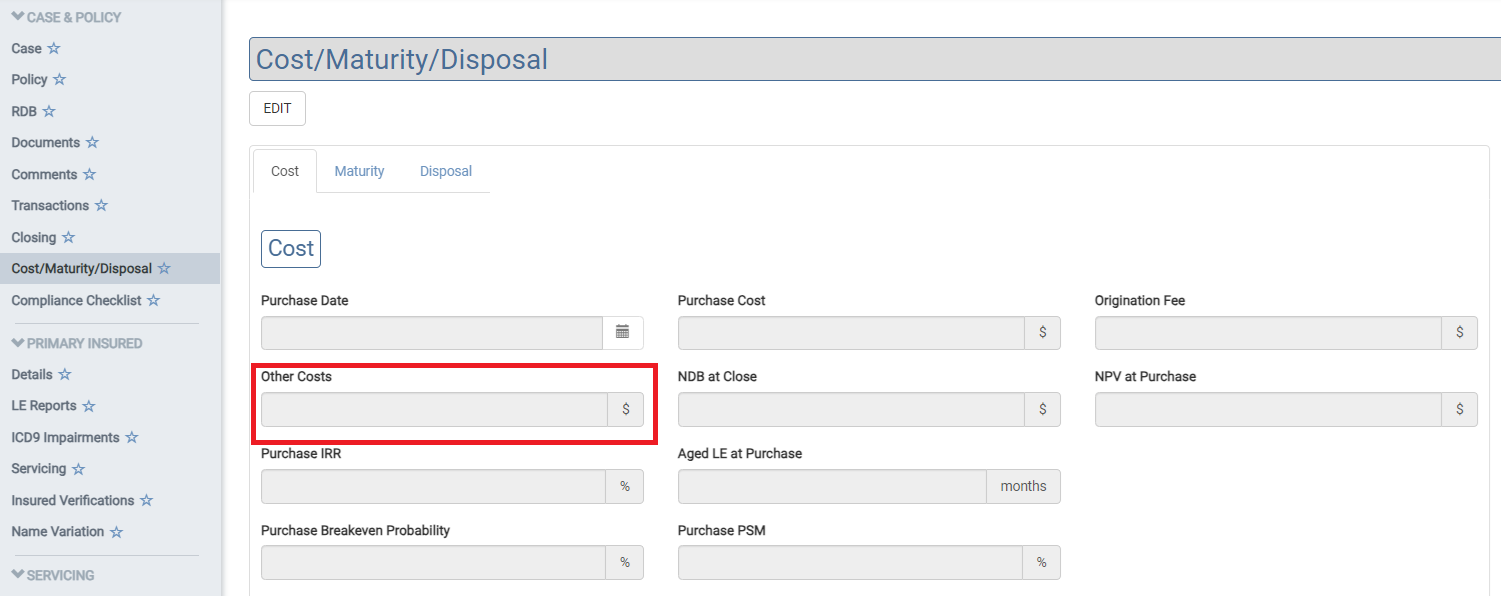

Include Origination Fee In IRR

As in the previous parameter, specify here whether the Origination Fee is included. The value comes from here:

Subtract the specified number from the Mean LE50

A global number of months to subtract from LE50 values when they are used in calculations.

Exclude Paid Premiums In Portfolio Valuation

When a paid premium is specified it can be subtracted from projected premiums if this parameter is true.

Use Previous Month NDB When Calculating Expected Cashflows

Some pricing models use the previous month NDB when calculating expected cashflows.

Premium Payment Day Of Month

All premiums can be shifted to a specified date in the month.

Premium Payment Day Of Month

If the previous parameter has a value other than “Do not Shift”, this parameter determines how they are shifted.

NPV Cap

The NPV of this case will be capped at the specified %age of NDB. If zero is specified, then no cap is applied.

Premium Payment on Value Date

The first premium payment after Value Date will be paid on Value Date. Note that this behavior is only suitable if the premium schedule is specified monthly (e.g. for a quarterly schedule, there are payments of zero specified between each quarterly payment)

Simplify Survival Rate Calculation

Specifying True for this parameter has the following impact:

- When constructing the survival probability curve, the day of month on which q(x) values occur relative to the policy monthiversary day are ignored. For example, if the q(x) is from an underwriter report with a report date of 14-mar-2025 and the policy date is 13-mar, when this value is True, the q(x) value will change in March. When it is False, the change will be in April.

- When calculating NPV, all payments are discounted to Value Date in full months, rather than based on an exact day count calculation.

- The survival curve is built with each date assumed to be 1 month apart, irrespective of the day of month on which Value Date occurs relative to policy monthiversary.