Accrual Analysis

ClariNet LS Provides the ability to analyze how the value of a policy evolves over time. Based on the current premium schedule and the survival curve, the model projects forward in time to look at the point at which the premium payments begin to make the policy unviable.

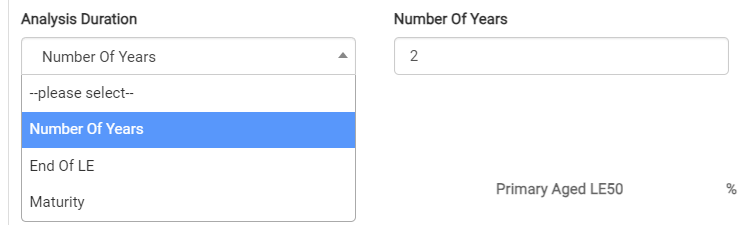

Analysis duration can be set to one of the types listed below

The Number Of Years field gets enabled only when the analysis duration is set to “Number Of Years”

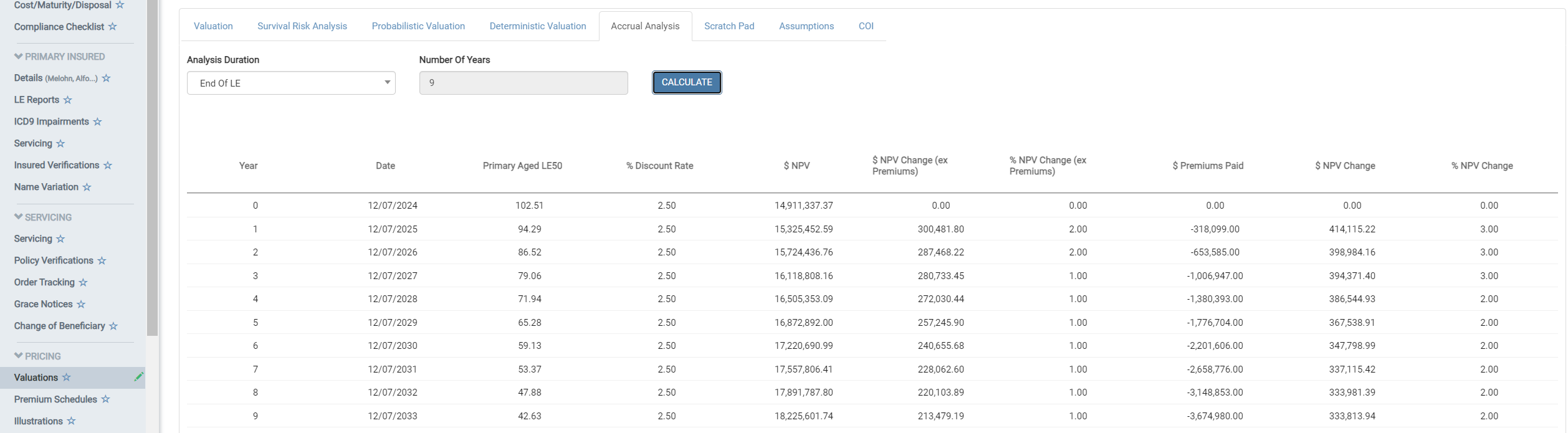

Results

- Primary/Secondary/Joint Aged LE50: the model calculates the aged LE50 values based on the survival curve.

- NPV: The forward net present value of the policy at the stated date.

- NPV change (ex premiums) % and $: this value shows the change in forward NPV relative to the previous year. For the “ex premiums” columns, the value excludes the NPV of the premium payments.

- Premiums Paid: this shows the cumulative total premiums paid since Value Date.

- NPV Change % and $: this shows the total NPV change including premiums.

Overriding Inputs

AgedLE50s

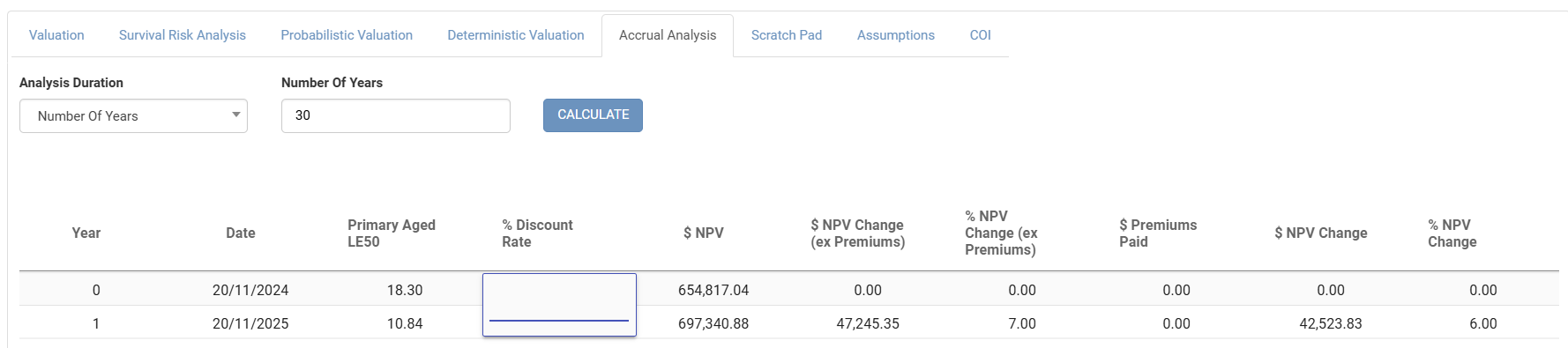

The Primary Aged LE50 and Secondary Aged LE50 can be overridden by clicking on the value and typing into the box. When you do this, the model uses that value on the specified date to calculate a new survival probability curve. Note that this override will cause the subsequent Aged LE50s to change.

Discount Rate

By default the Discount Rate is taken from the NPV IRR in the Valuation Template. Similar to the Aged LE50s, this value can be overridden.

Premium Holidays

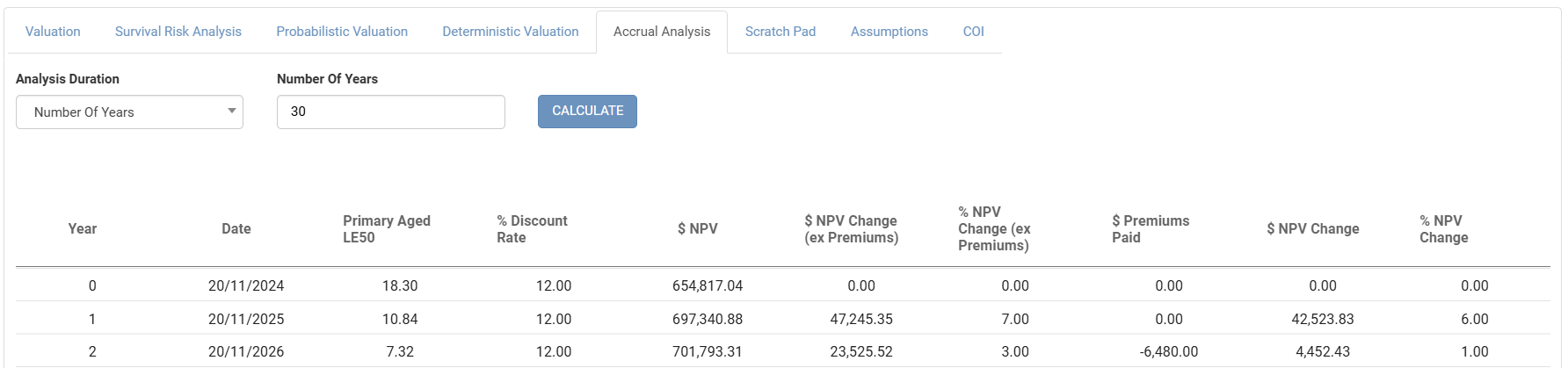

In the example below there are no premium payments during the first two years.

The difference between the first two NPV values is $42,523.88. This reflects the impact of moving the Value Date forward. As the positive expected NDBs are discounted less, they increase in value. However, as the expected premiums are also discounted less, they negatively impact the total NPV.

The column “NPV Change (ex Premiums)” does not include the projected premiums, therefore it only reflects the increased NDBs and therefore has a larger positive change ($47,245.35).