Valuation Settings

Using the Valuation Settings page you can set or pre-select values in these categories:

- LE reports

- Illustrations

- Premium Schedules

- Policy Verifications

- Custom IRR’s set

- Premium Payments between Account Value Date and Optimization Start date

For each, you can either select a particular item or use the most recent item.

These values are then used as follows:

- To pre-populate the Single Case Valuation input parameters when adding a new Valuation

- During Portfolio Valuation, Monte Carlo, A2E, Portfolio Generator and Risk Analysis, each Case’s Valuation Settings is used to set the Valuation input parameters

The settings saved on the Valuation Settings page will directly reflect on the Valuations page.

Primary Tab

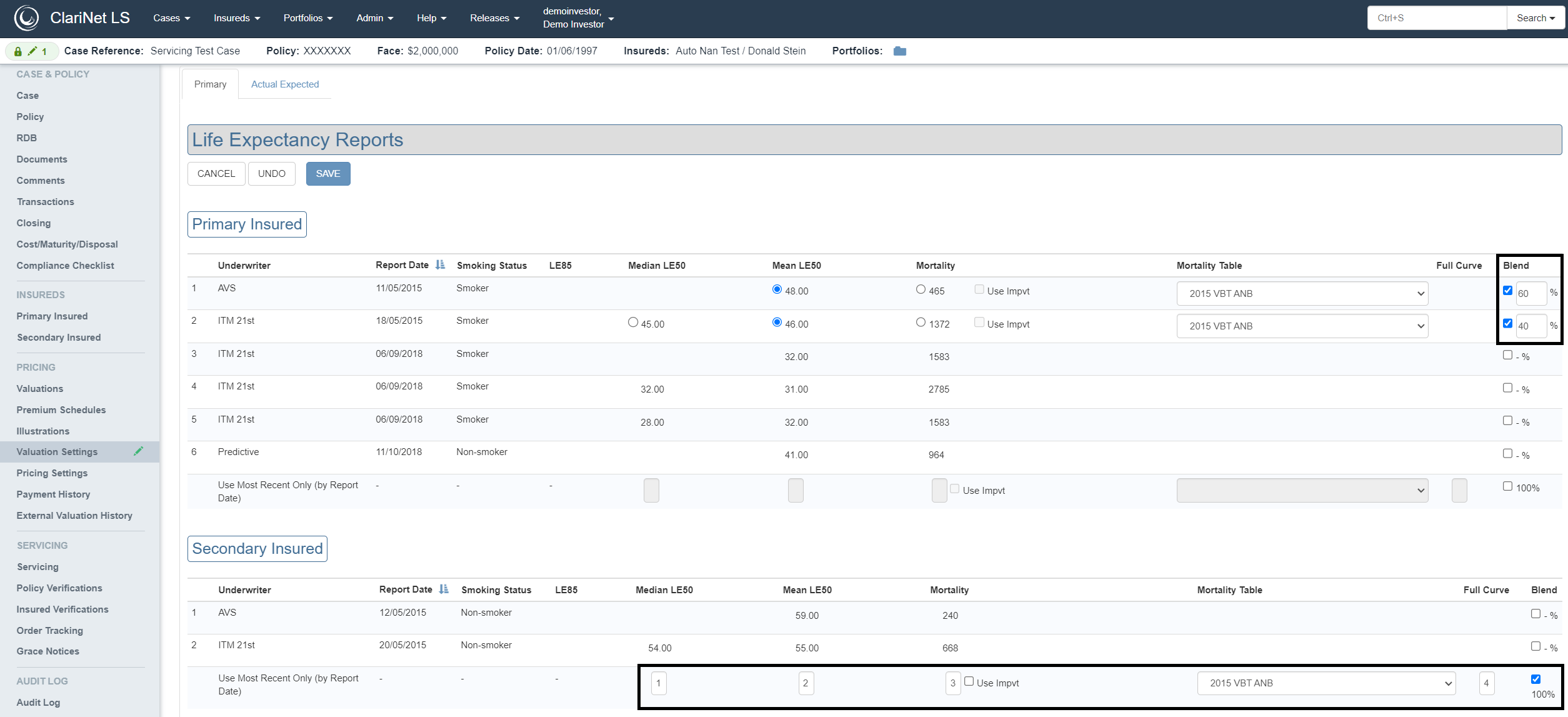

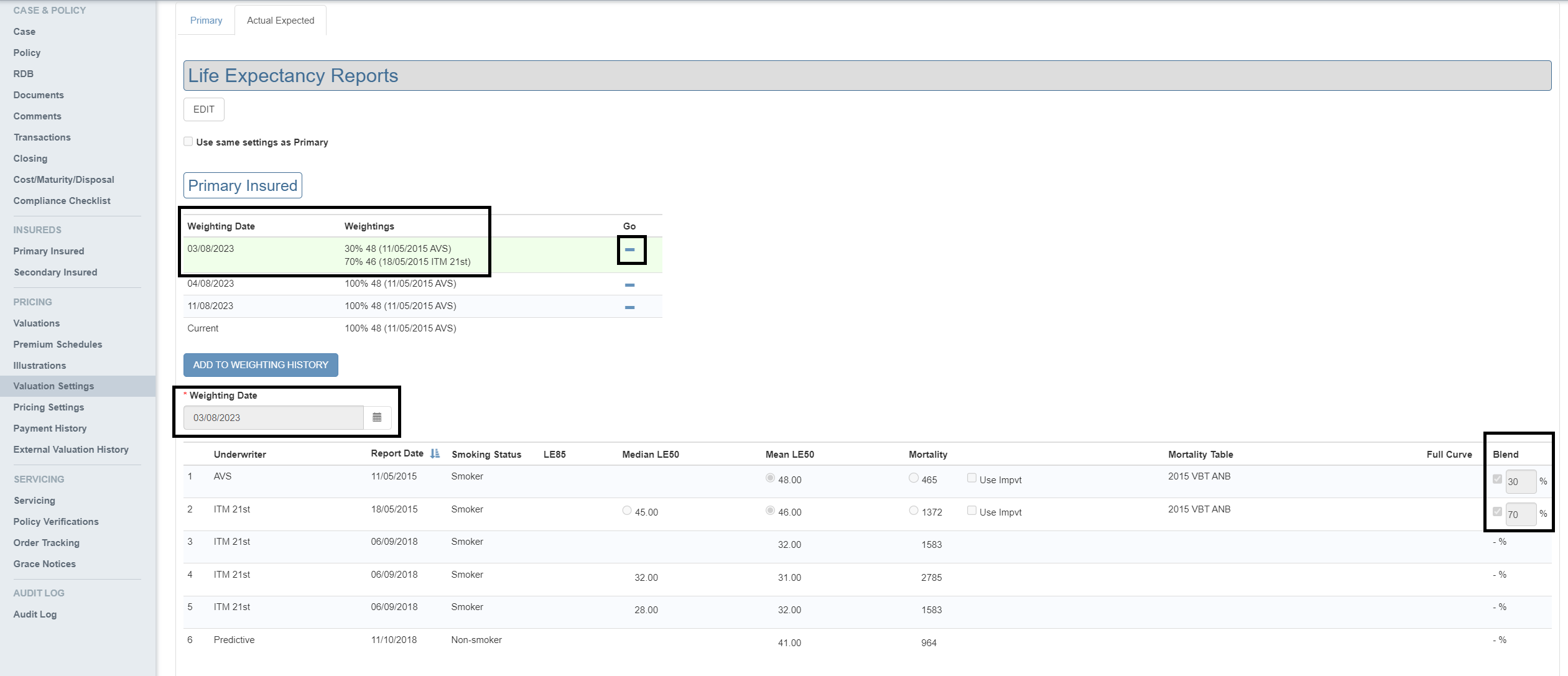

ClariNet LS supports dynamic selection and blending of LE reports when valuing a case. You can pre-select LE reports for both insureds and blend percentages as shown in the screenshot below.

If the option Use Most Recent Only (by Report date) is selected, then the value in the text boxes (e.g. 1, 2, 3 or 4) for MedianLE50, Mean LE50, Mortality and Full Curve determine which data point is to be used from the Most Recent LE Report in the specified order of priority as shown in the screenshot below for Secondary Insured.

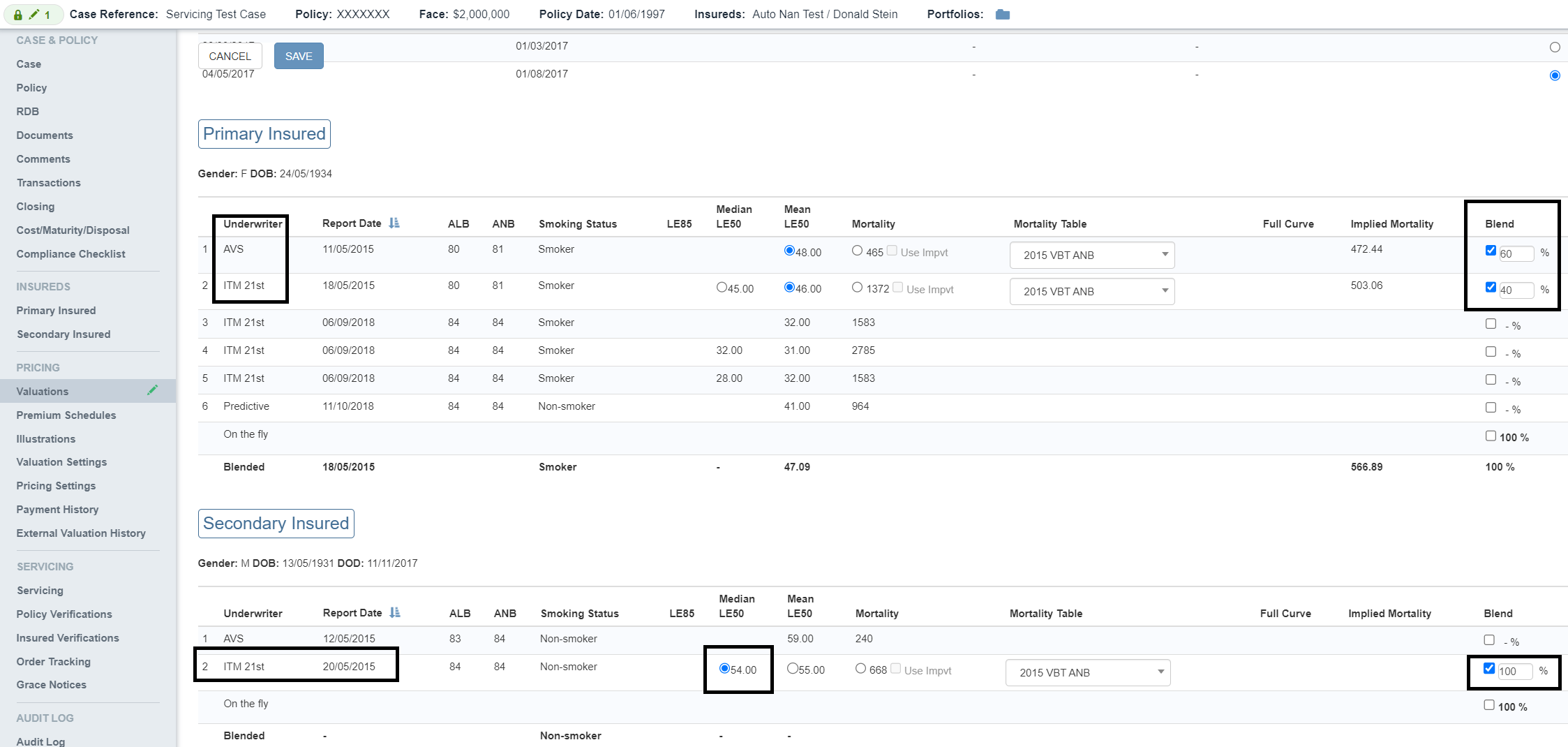

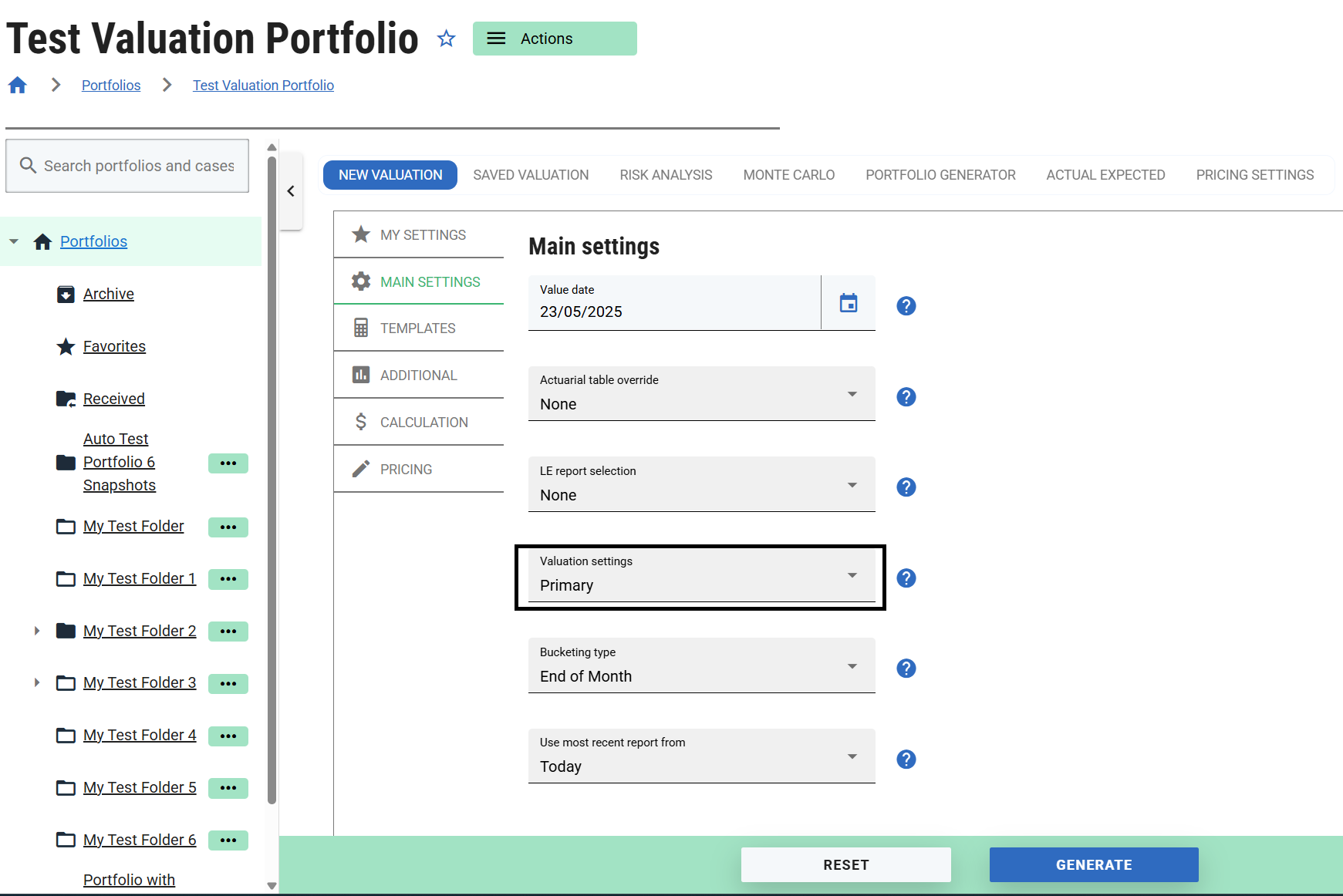

When adding a new Single Case Valuation, the page will be pre-populated with the values you have selected on the Valuation Settings page. Using the example above, the Valuation page appears as below:

Primary Insured

AVS and ITM 21st are selected for Primary Insured with a blending percentage of 60 and 40.

Secondary Insured

AVS has been pre-selected for Secondary Insured as it is the most recent report with Median LE50 selected; the selection of Median LE50 is due to the priority set on the Valuation Settings page. Median LE50 has the highest priority, then Mean LE50, then Mortality.

If the Most Recent LE report did not have Mean LE50 or Median LE50 values specified, then Mortality would have been pre-selected as it is the third data point as per the priority.

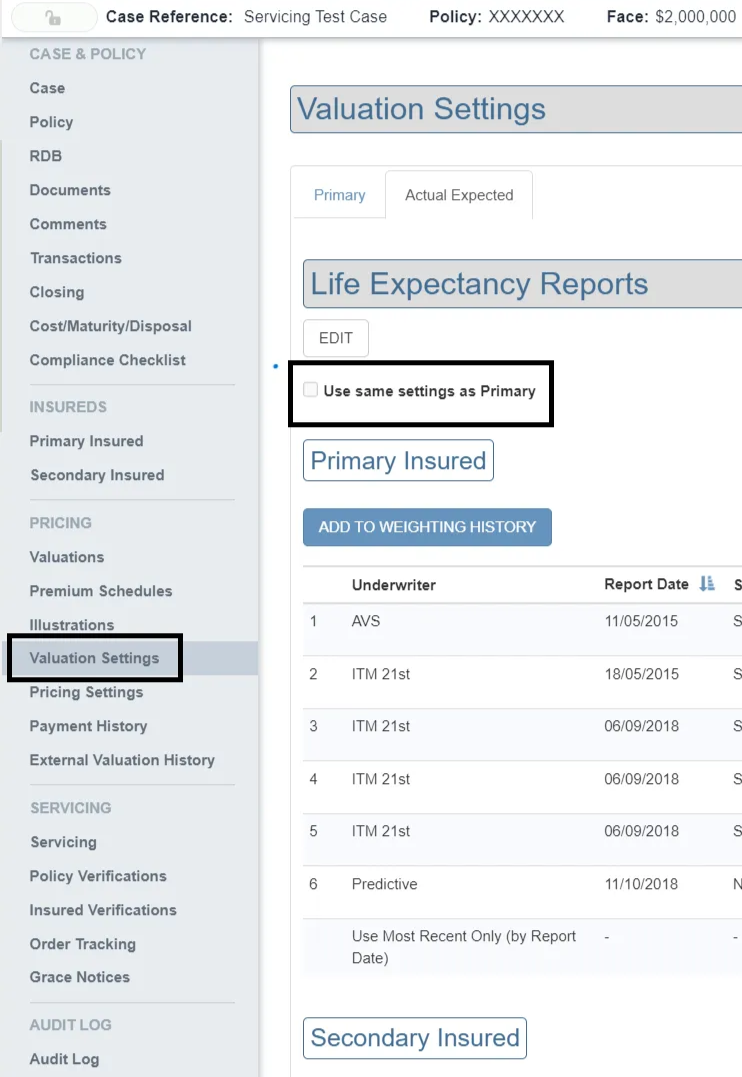

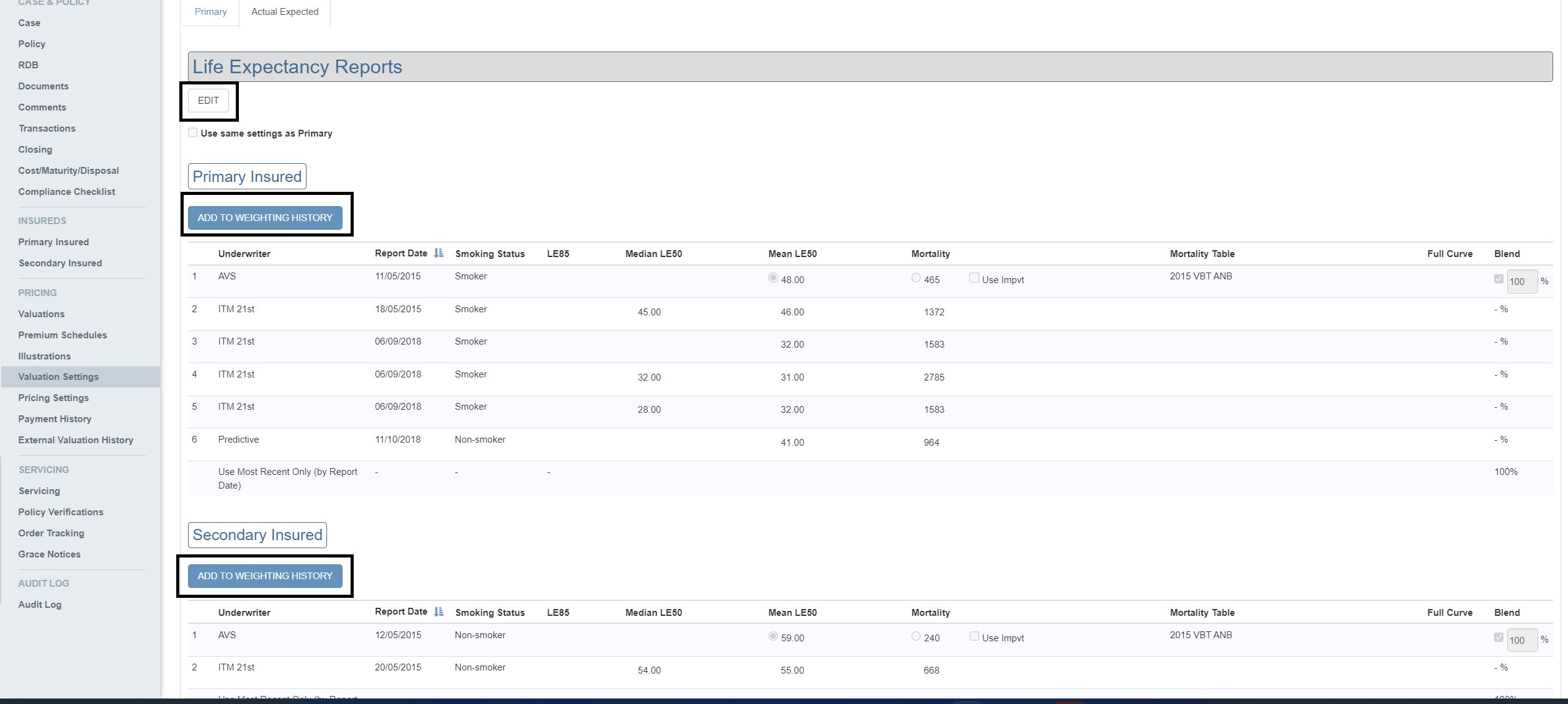

Actual Expected Tab

The Actual Expected tab lists all the LE reports, Illustrations, Premium Schedules, Policy Verifications and Custom IRRs added to the case as in the Primary tab. You can pre-select these values which will be then used by the Actual vs Expected for a Portfolio. The Actual Expected tab also allows you to add historical weighting dates for LE Reports.

The checkbox Use same settings as Primary determines whether to use the same Settings for both Primary and Actual Expected or use different settings. Disabling it will enable all the fields in the selected tab.

Note: To add historical weightings, ensure that the Actual Expected tab is in read-only mode, prior to which LE reports for Insured’s on Actual Expected tab should sum to 100%.

By clicking on the ADD TO WEIGHTING HISTORY button shown above, you will be able to add the required Weighting Date.

A table is then created just above the ADD TO WEIGHTING HISTORY button and the selected weighting date will be highlighted in green. The table shows Weighting Date and Weightings corresponding to that date, as shown below. You can add as many weightings as required. Each weighting can be edited by simply clicking on the EDIT button.

Note: Weighting date should be unique and duplicates are not allowed.

You can easily switch to the required weighting and edit it as required; green highlight indicates which weighting you are working on.

These historical weightings will be used by the Actual vs Expected for a portfolio when the Durational probabilistic checkbox is selected.

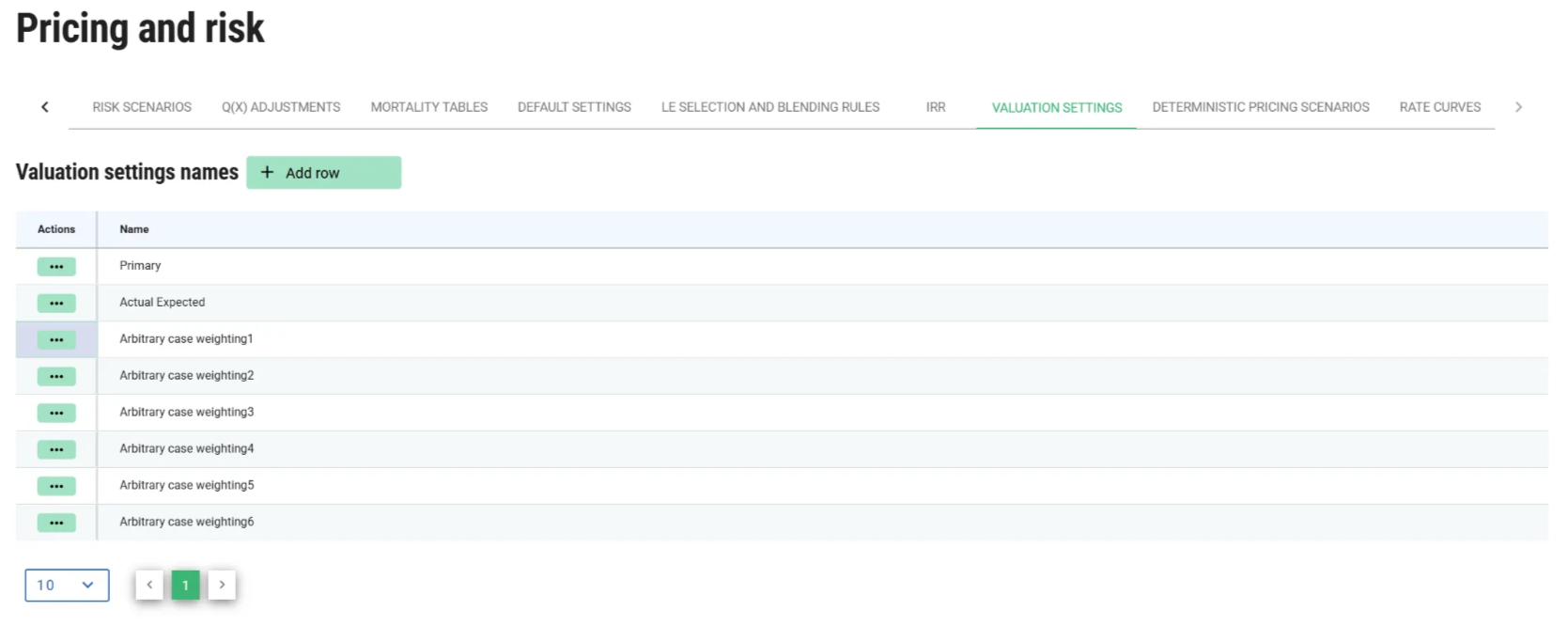

ClariNet LS allows you to add new valuation setting names, which will be available as an option on all of the case valuation as well as portfolio valuation pages.

New valuation setting names can be added from the Valuation Settings tab under the Settings→ Pricing and risk page. Primary and Actual Expected are the default weighting names.

Click on the add row button to add new weighting names. Example shown below.

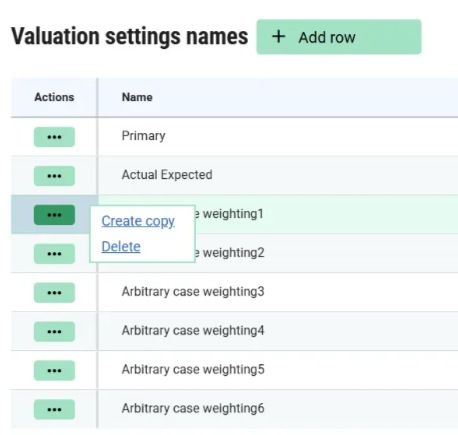

Click on the menu for a selected setting to view the Create copy option, which allows the user to copy an existing valuation setting. Copied valuation setting is copied over to all the cases.

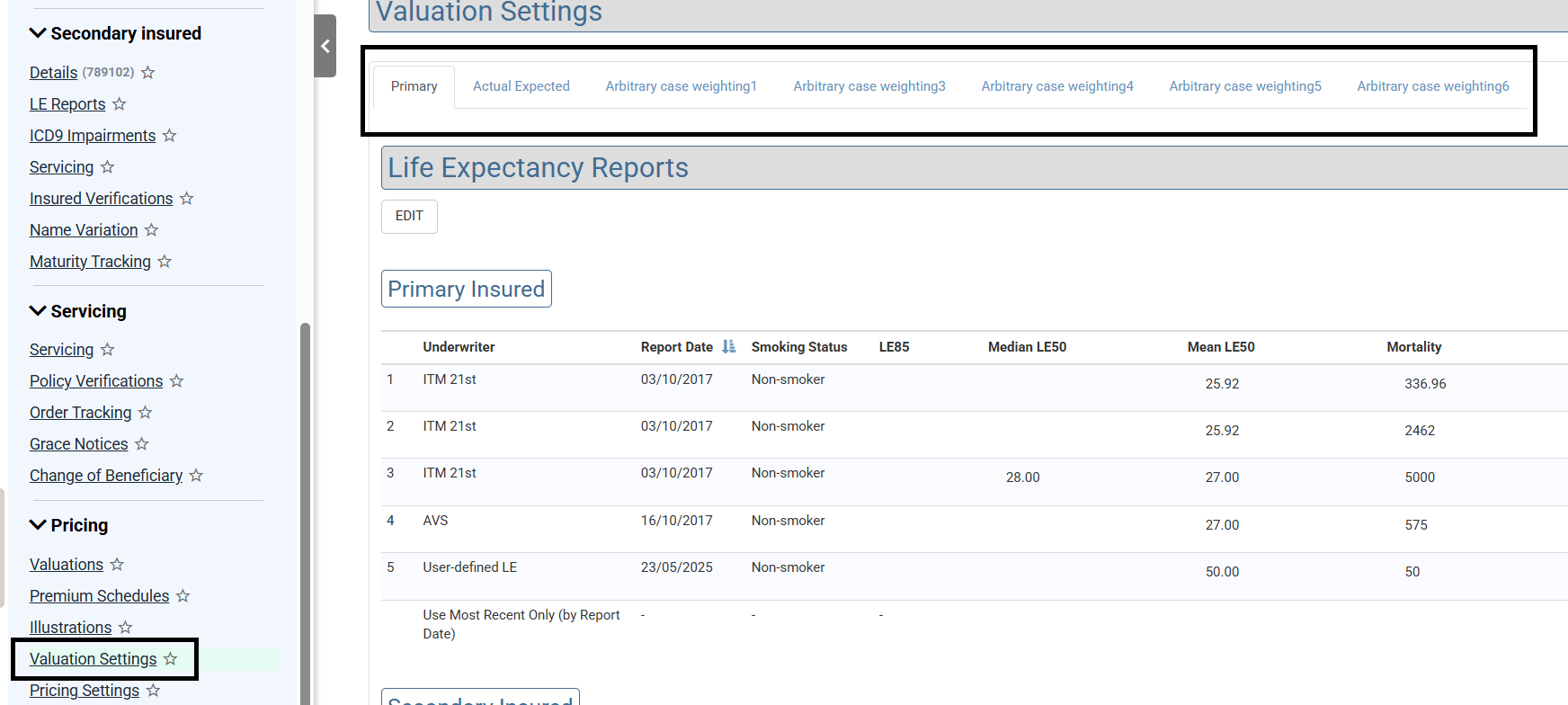

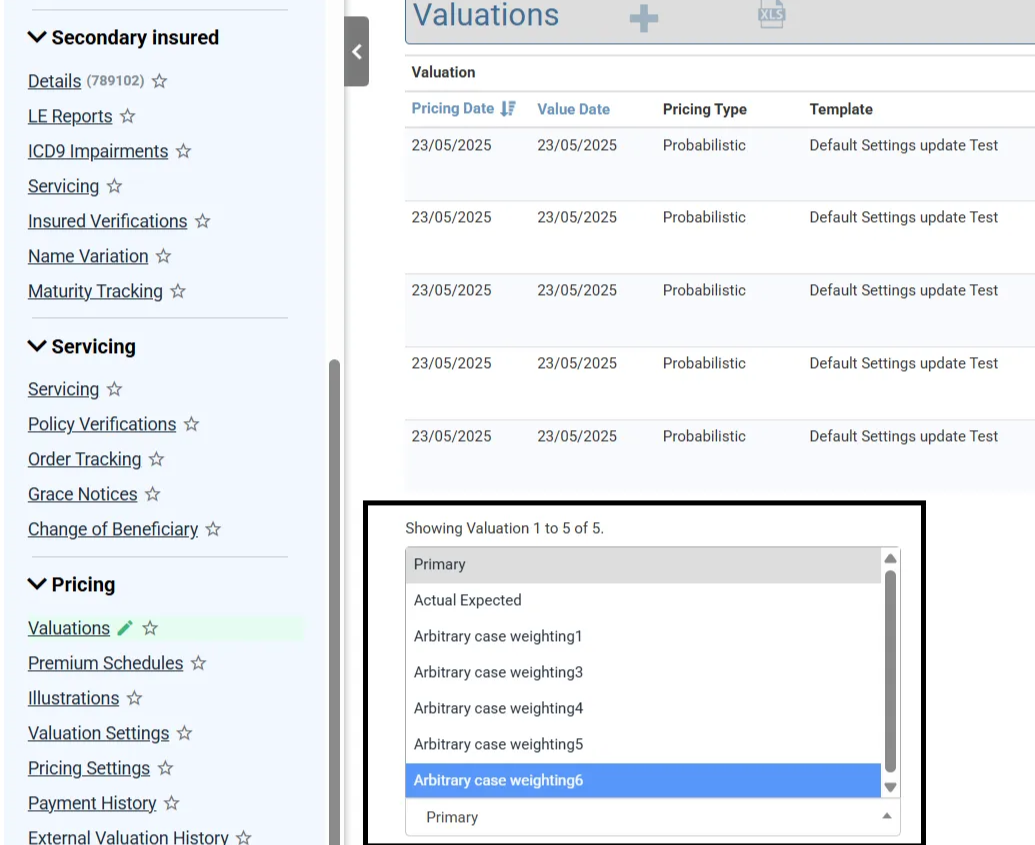

Newly added weighting names will be listed on

- Valuation settings page

- Valuations page

- Portfolio valuations page (Monte Carlo, Actual Expected and Portfolio Generator)

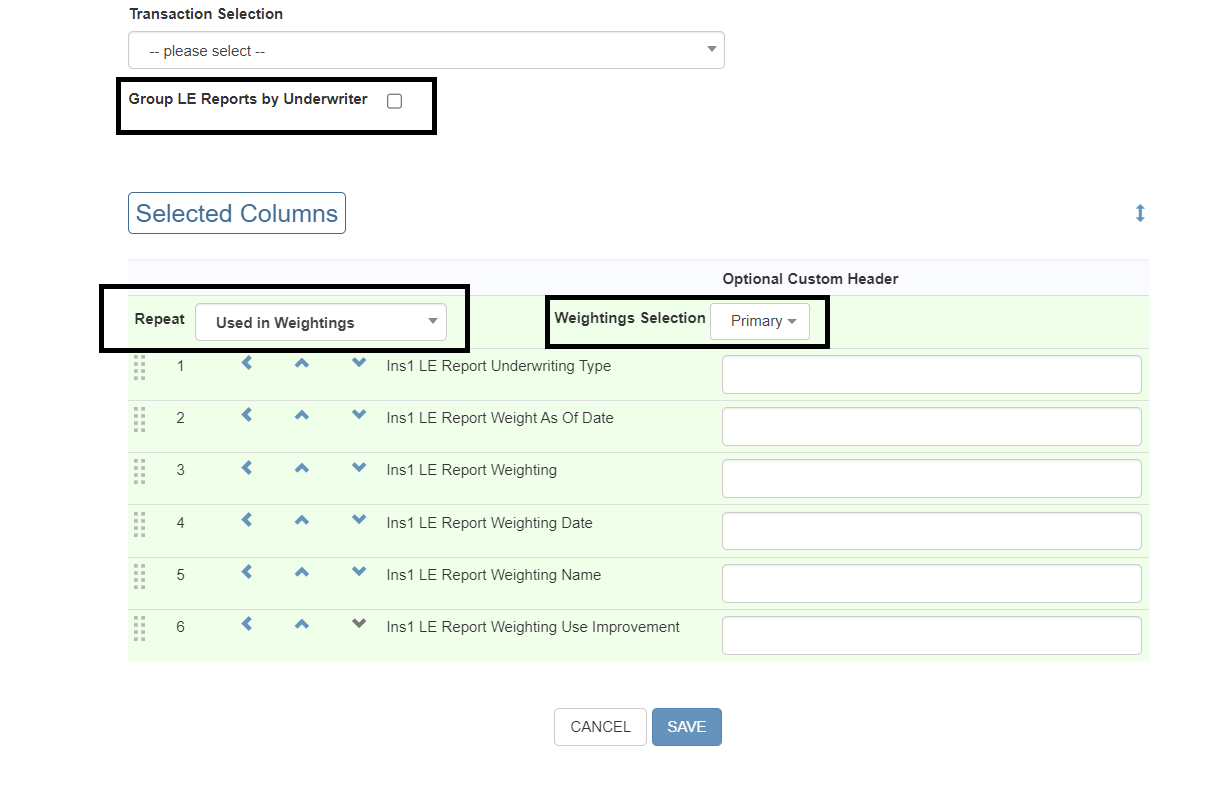

Using Weightings in Custom Reports

Weighting date and other fields are also included in Custom Reports. They are available in each of the relevant entity section (Primary Insured LE Reports, Secondary Insured LE Reports).This can be done from Admin → Exports and reports page. Select your preferred custom report on exports and reports page. The preferred weighting columns that needs to be displayed on the report can be selected from Insured’s LE Reports section.

Selected columns for your custom report will be listed as shown below.

Other features that can be included in your custom report are :

- Grouping LE reports by underwriter which will cause LE reports from different underwriters to use separate set of columns.

- Weightings selection can be set to Primary/Actual Expected/New case weighting names/Actual Expected Weighting History or ALL can be selected.