Premium Optimization

How does ClariNet LS calculate the COI for each policy?

The answer really depends on how much detail you want to go into. The simple answer is we take the account value at the start of a policy year and project it forward each month, calculating the credits and debits during that month. One of the debits is the monthly COI. At the end of the policy year, we have the account value and cash surrender value. Basically, we guess a value for the COI Rate and look at the end of year AV or CSV (depending on lapse basis) and threshold. We calculate how far away we are from the threshold and guess a new value for the COI Rate. This is repeated until we match the threshold AV/CSV value.

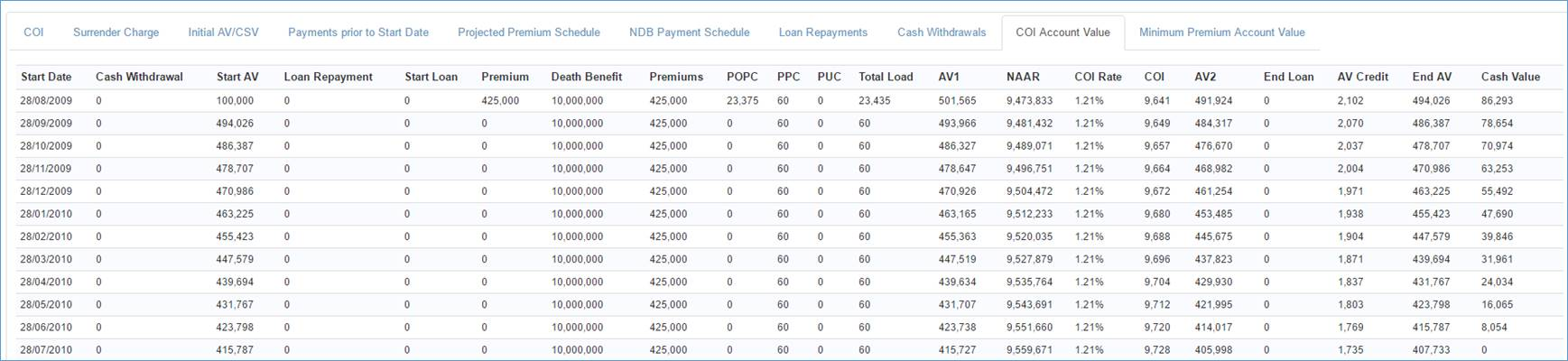

If you look on the premium calculator page and click on the COI Account Value tab, you can see the calculation:

In this example, we have guessed a COI Rate value of 1.21% in order for the AV to start at $100,000 and for the CSV to end at $0. Obviously one of the key inputs to this calculation is the net amount at risk (NAAR), which is basically NDB – AV; that figure is multiplied by the COI Rate to get the COI. I’m slightly simplifying things because this example is a full policy year. For the first period of an illustration, we may have less than a year from illustration date to the end of that policy year. For these “stub” start periods, we would apply a fraction of a month of COI and a number of full months to get from illustration date to the end of that policy year.

How do you quickly calculate an initial ACV/CSV based on the first ACV/CSV in the ledger?

If you don’t have an initial AV/CSV, you can take the COI from the next full policy year and extrapolate it backwards. You can then use that extrapolated COI to imply the initial AV/CSV.

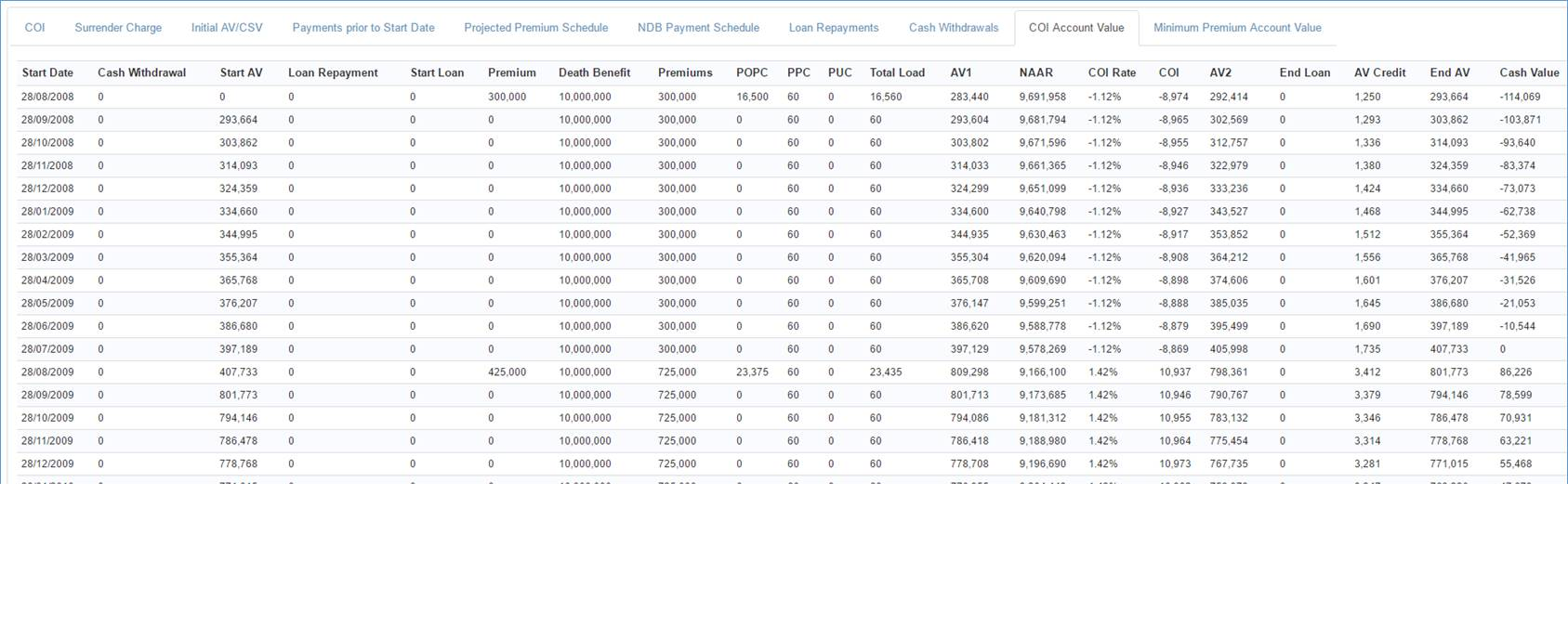

In this example, we do have a starting AV/CSV, but the specified value of $0 implies a negative COI, so ClariNet LS allows you to ignore it:

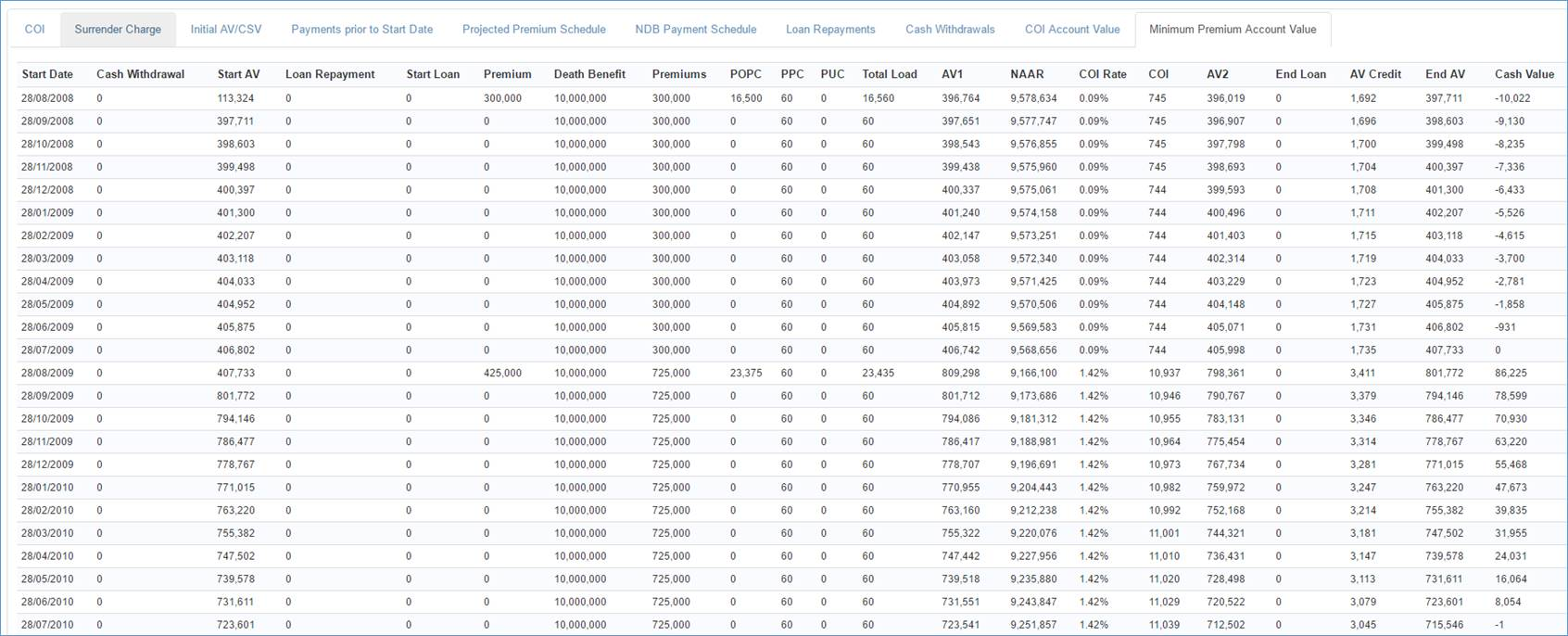

We therefore calculate an extrapolated COI of 0.09% (this is calculated from the ratio of COI/qx from the second period COI of 1.42%). We use this to calculate a starting AV of $113,324, shown in the minimum premium account value tab:

The process of getting the $113,324 is similar to solving for COI in that we guess an initial AV, use the extrapolated COI to calculate the end AV and repeat the process until we match the $0 on 28-jul-2009.

The attached spreadsheet shows a single row of the calculation in the screenshot below. You would need to do this each month, propagating the account value forward. There is some conversion between the 1.21% annual stated COI figure and the actual rate that goes into the COI amount; you can see that in the sheet.

coicalc.xlsx