Custom IRRs

The Net Present Value (NPV) of cases in ClariNet LS are typically calculated using the Internal Rate of Return (IRR) specified in the Valuation Template. However, this IRR can be overridden at a case level using Custom IRRs.

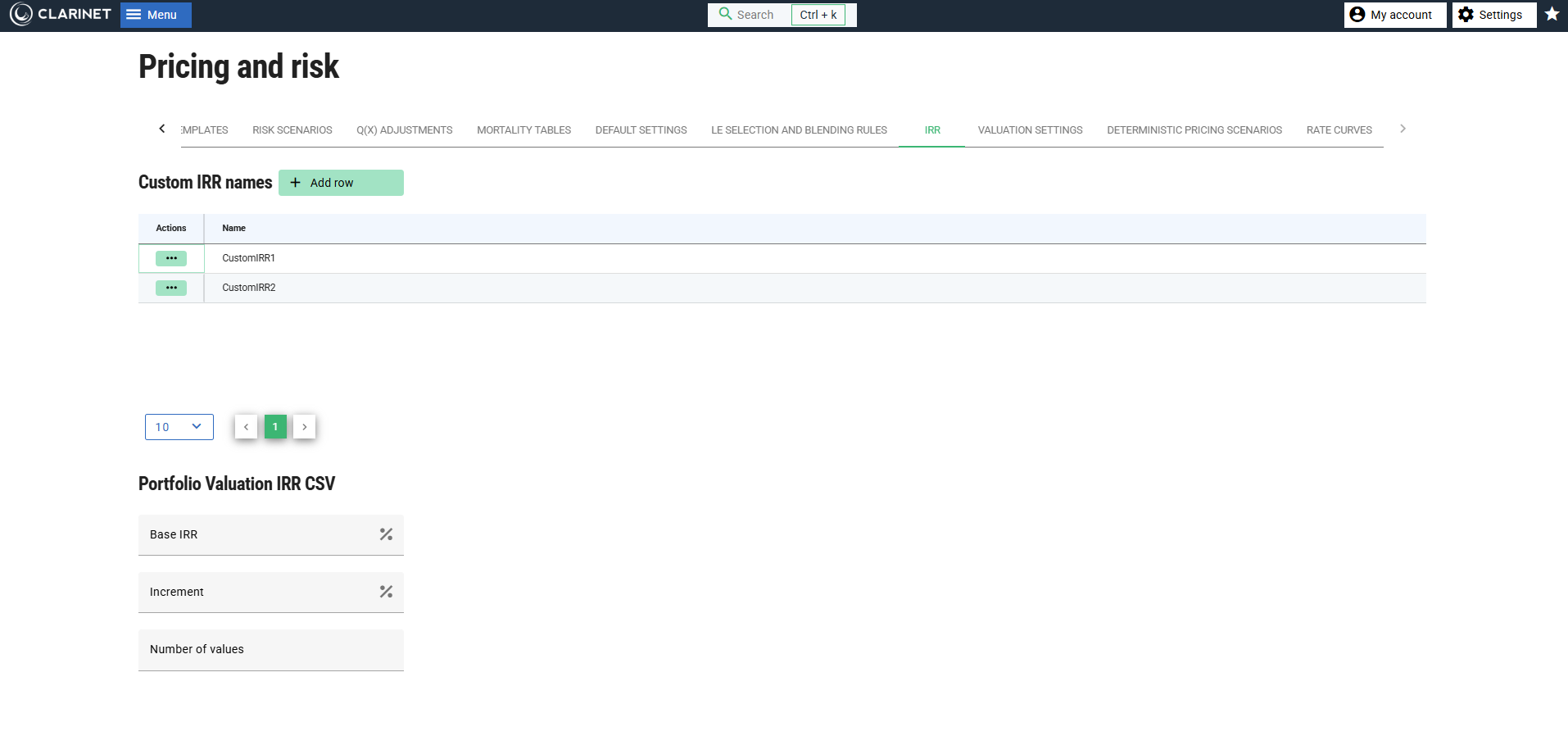

Specifying Custom IRRs

The names of Custom IRR values must first be specified in the Pricing and Risk -> IRR section, like this:

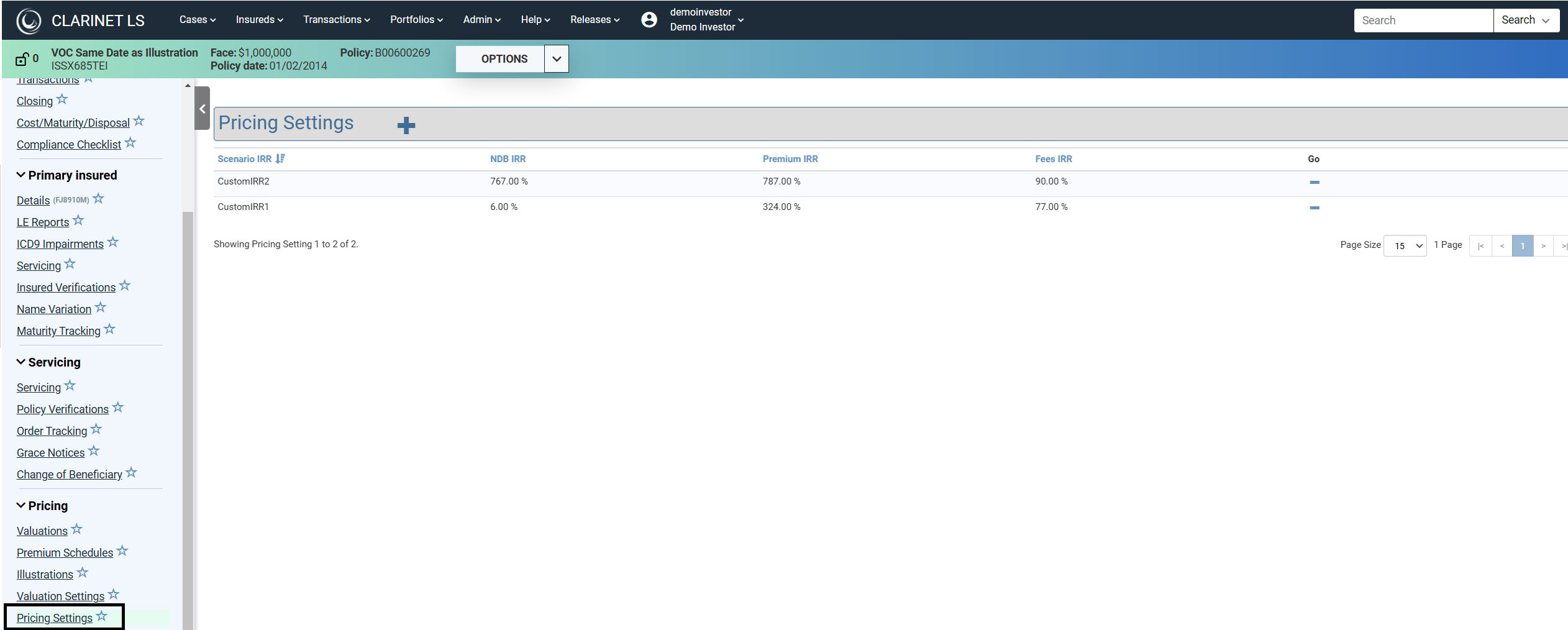

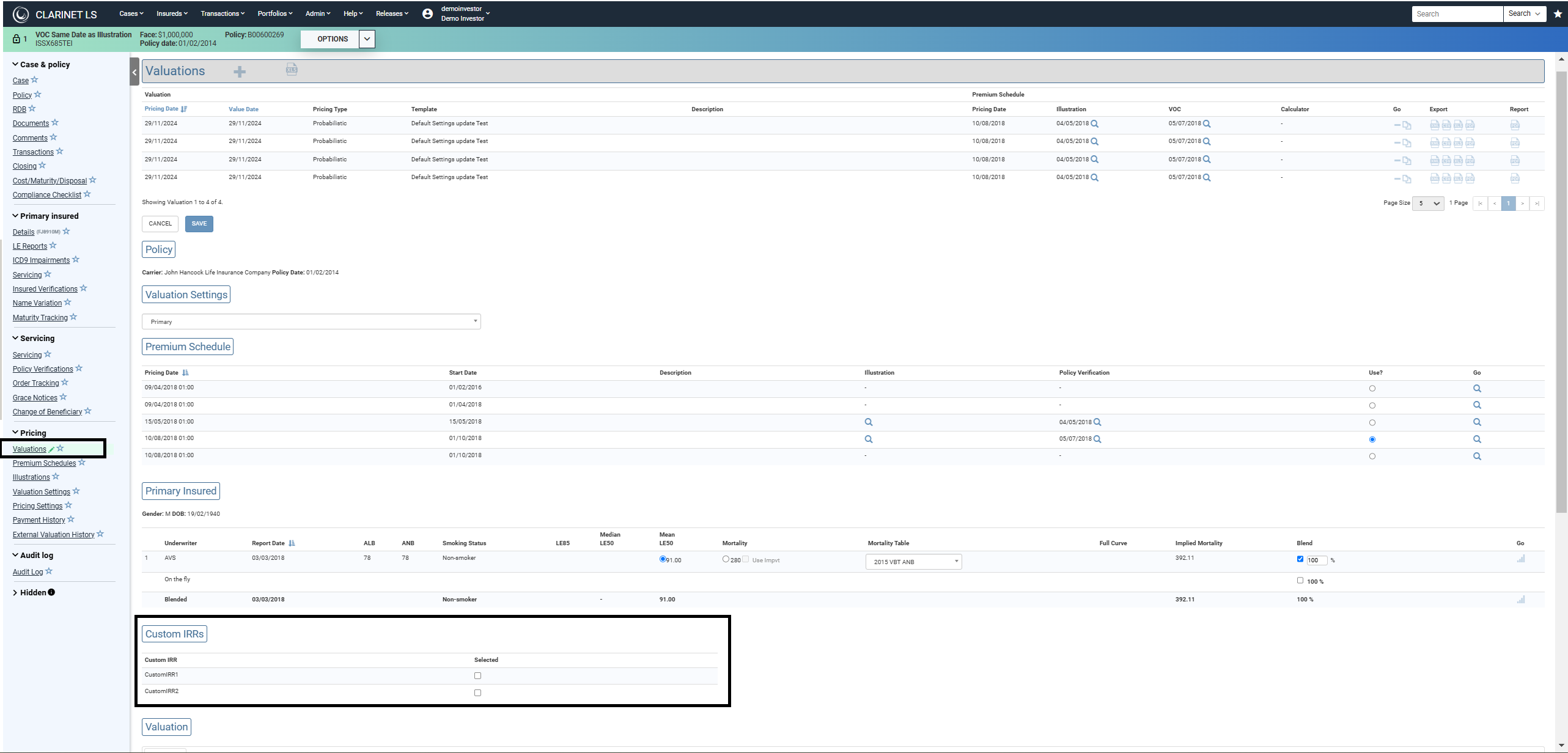

Once the names are created, you will be able to specify values for these at a Case level, like this:

Alternatively, Custom IRRs can be uploaded using the Excel Portfolio Uploader.

Using Custom IRRs

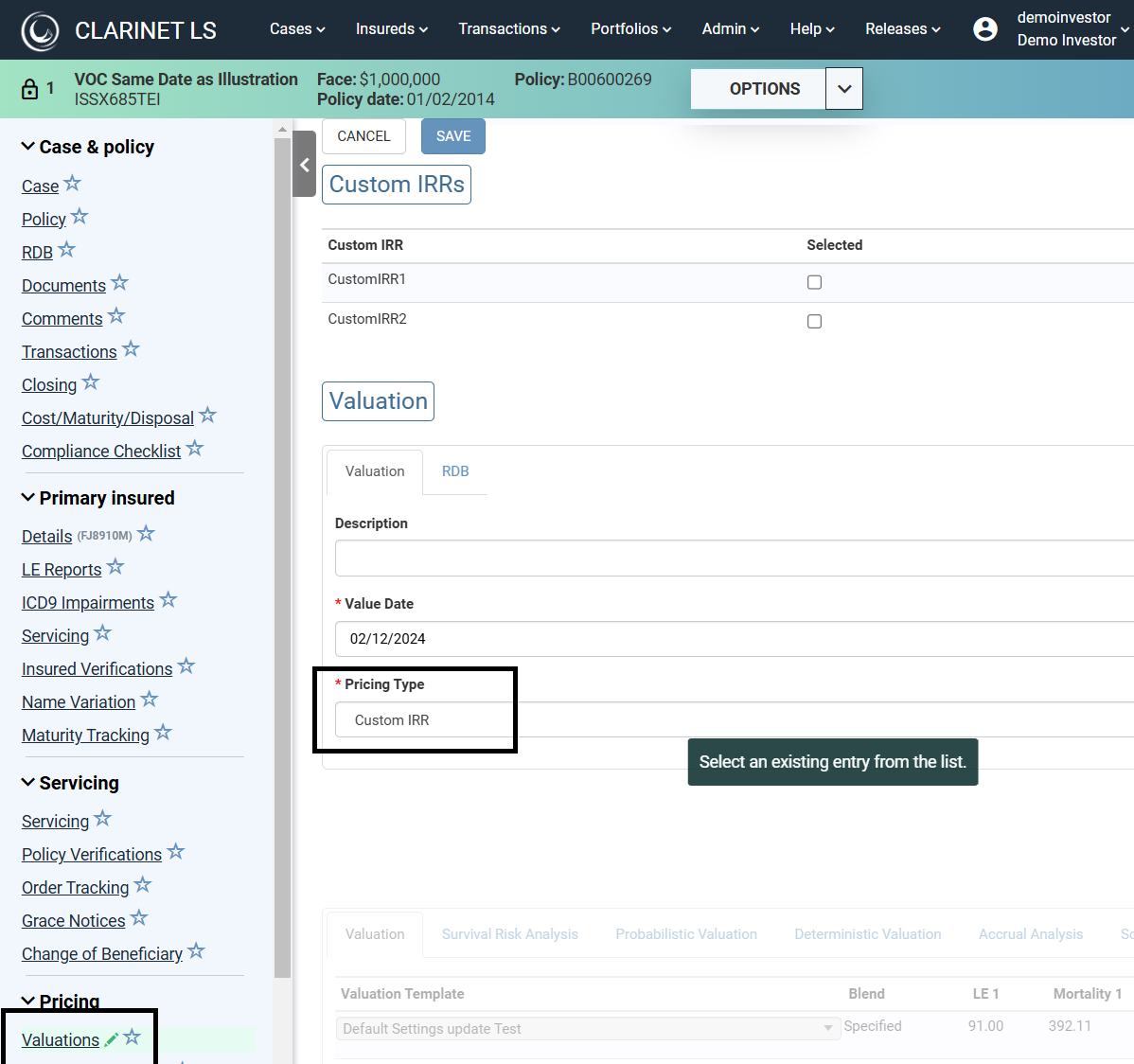

On the single policy valuation page, once Pricing Type Custom IRR is selected as shown below, a box will appear where the Custom IRRs can be selected:

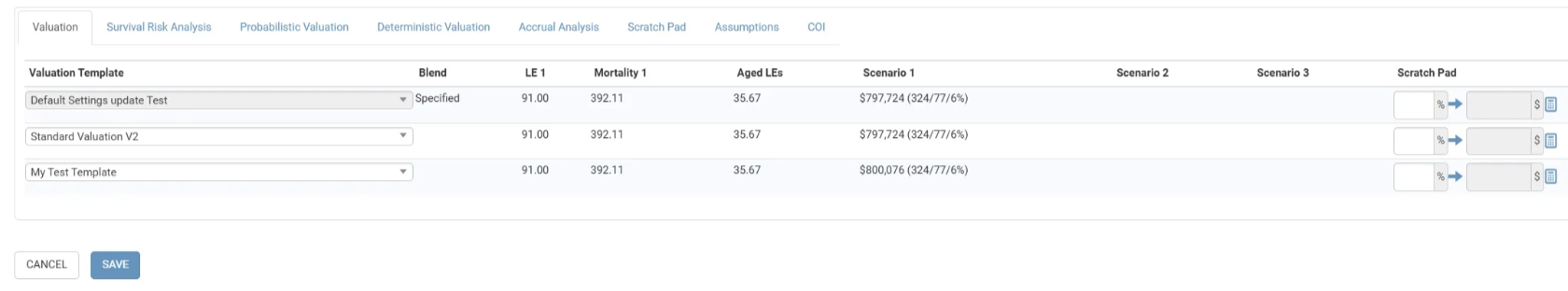

The results of case valuation using these Custom IRRs will appear in the Valuation tab:

Scenario 1 corresponds to CustomIRR1 and Scenario 2 corresponds to CustomIRR2.

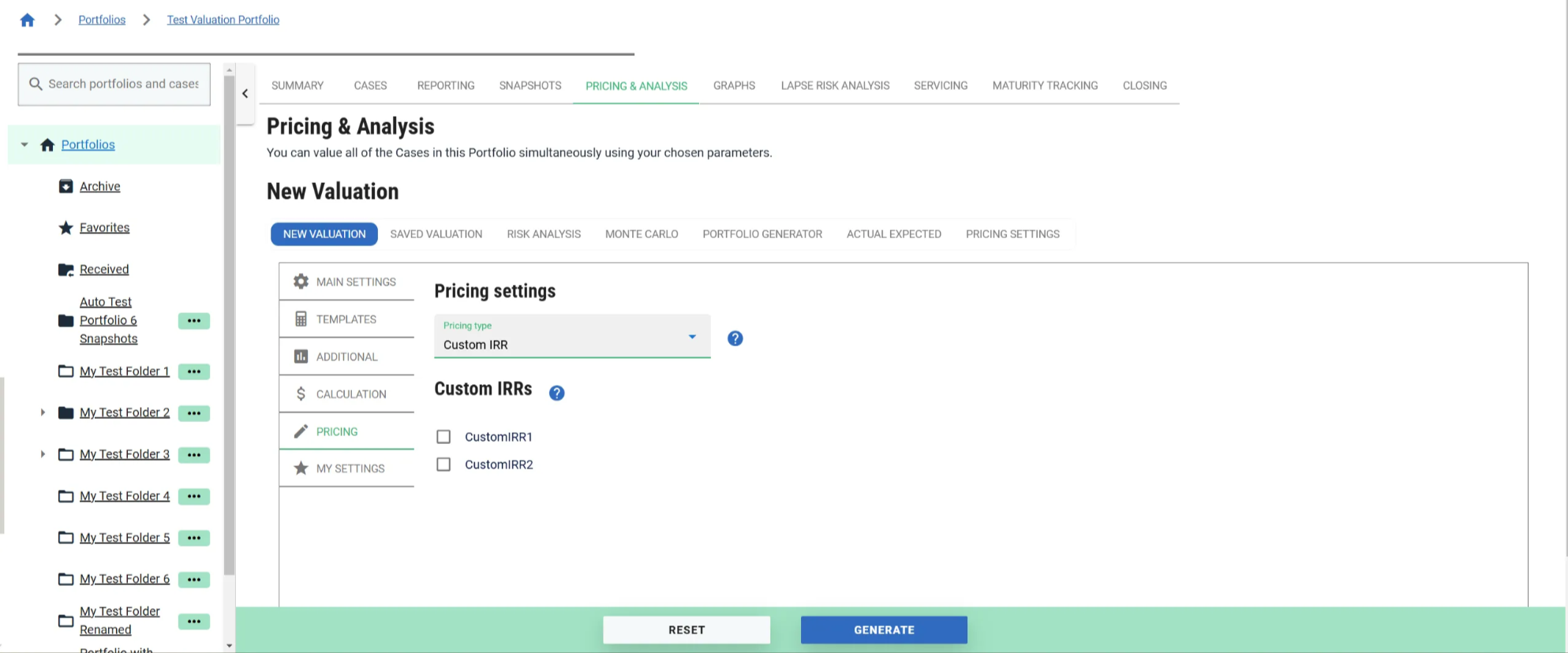

Using Custom IRRs in Portfolio Pricing

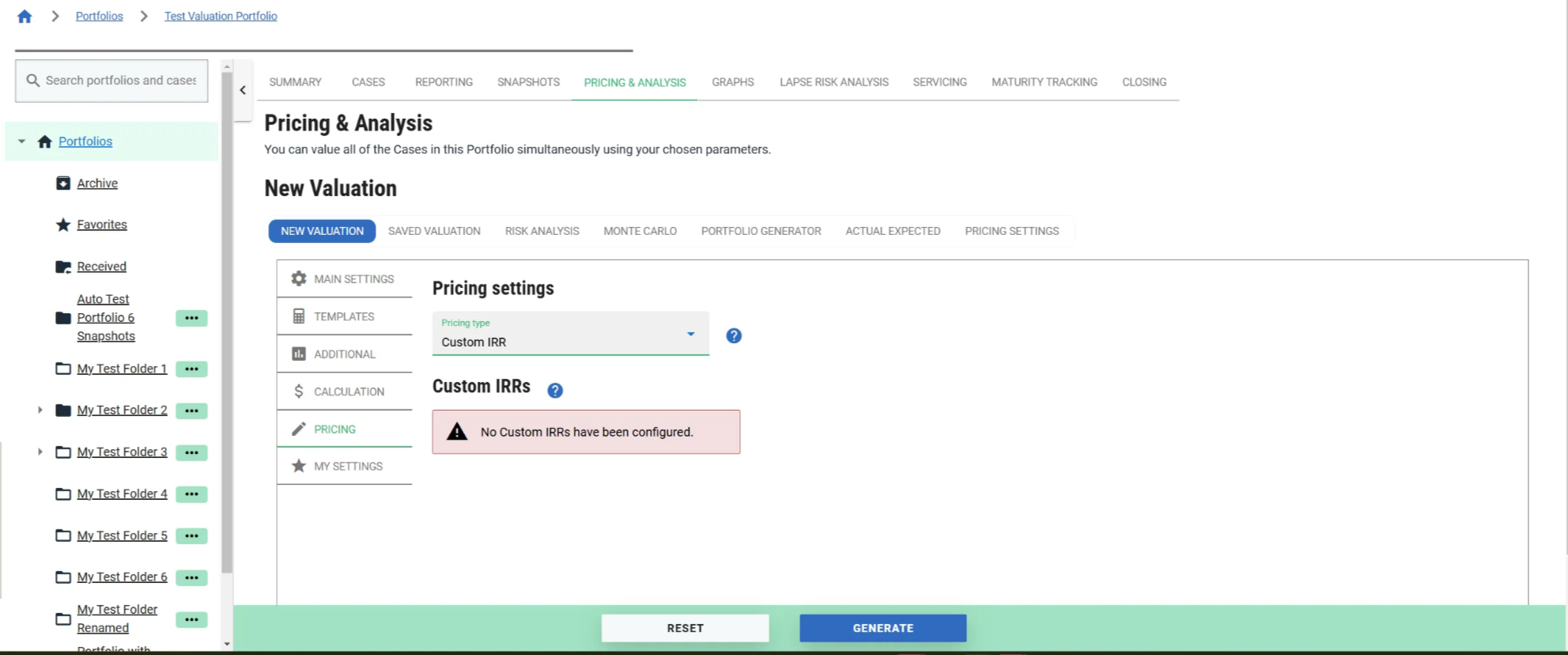

The portfolio pricing page has the same functionality as the single policy pricing page for Custom IRRs:

All the cases in a portfolio will need to have Custom IRR settings for any calculation performed at the portfolio level, otherwise an error will appear, see below.