Interpolation of Mortality Curves

Overview

The ClearLife pricing model has been extended to support piecewise linear interpolation of both the mortality rate

| Interpolation Type | Meaning |

|---|---|

| Piecewise Constant Qx | q_x constant between underwriting dates. |

| Piecewise Constant Force Of Death | λ constant between underwriting dates. |

| Piecewise Linear Qx | q_x linearly interpolated between u/w dates. |

| Piecewise Linear Force Of Death | λ linearly interpolated between u/w dates. |

The Specification of Mortality

For the purposes of this document, we assume that underwriters supply either:

the survival curve

or the mortality curve

In the case of the survival curve, we will back out the mortality curve using:

Interpolation

Given that we have

| Underwriter | t=0 | t=1 | t=2 | t=3 | t=4 |

|---|---|---|---|---|---|

| Date | 2-sep-2011 | 2-sep-2012 | 2-sep-2013 | 2-sep-2014 | 2-sep-2015 |

| q x (t) | 25/1000 | 50/1000 | 75/1000 | 100/1000 | 125/1000 |

Given

We show the four common approaches:

- Piecewise constant

; - Piecewise linear interpolation of

; - Piecewise constant exponential interpolation of hazard rate (λ);

- Piecewise linear exponential interpolation of hazard rate (λ);

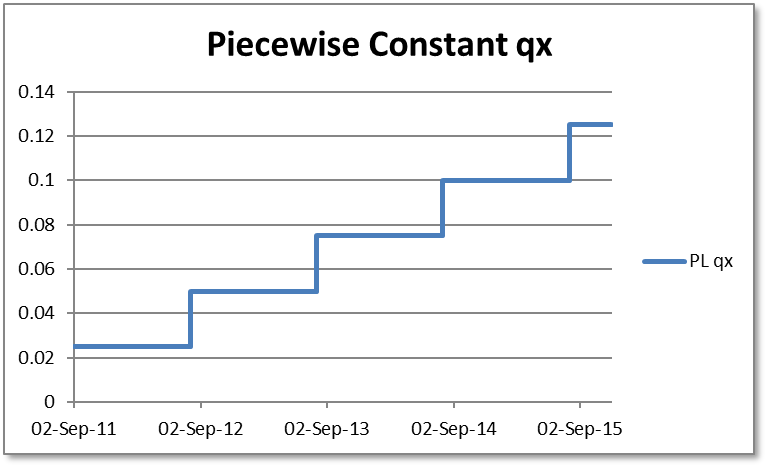

Piecewise Constant Interpolation of qx

With this approach, we simply assume that

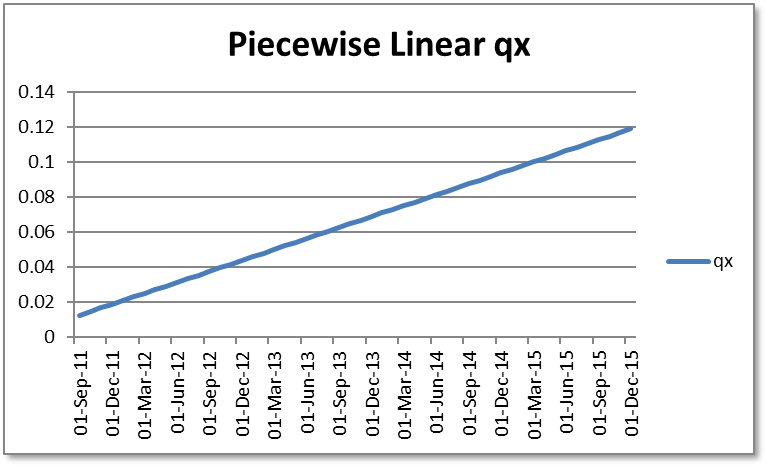

Piecewise Linear Interpolation of qx

In the case of piecewise linear interpolation of

The resulting graph is:

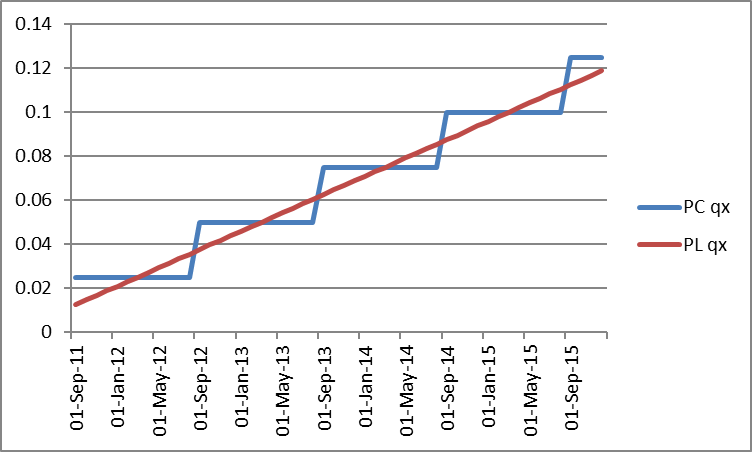

To contrast the two calculations, the following graph shows them together:

From the graph, it can be seen that in the piecewise linear version, during the first half of an underwriting year, the value is below the piecewise constant value and in the second half of the year it is above. So on 2-sep-2011, PC

Exponential Interpolation of Hazard Rate (PC and PL)

The exponential hazard rate model assumes that within each year, mortality events are independent, continuous and occur at a constant rate. For each given value of qx(t), a survival probability is calculated;

Since t=1, the value of λ is calculated as

This gives a table like this:

| Date | q x | p x | λ |

|---|---|---|---|

| 2-sep-2011 | 0.025 | 0.975 | 0.025318 |

| 2-sep-2012 | 0.05 | 0.95 | 0.051293 |

| 2-sep-2013 | 0.075 | 0.925 | 0.077962 |

| 2-sep-2014 | 0.1 | 0.9 | 0.105361 |

| 2-sep-2015 | 0.125 | 0.875 | 0.133531 |

The interpolation method for piecewise linear λ uses the same approach as