NPV/IRR of Matured or Disposed Cases

Overview

This page describes the approach ClariNet takes to the pricing of Cases where the Insured (or, for a second-to-die joint life policy, both the Insureds) are marked as deceased or the Case is marked as having been Sold or Surrendered. For these cases, there are three possible Case States:

- Maturity Claim Pending;

- Maturity Claim Paid; and

- Sold/Surrendered (referred to as disposed in this page). The Case State is determined based on the information entered on the Cost/Maturity/Disposal tab for a case.

Case State: Maturity Claim Pending

For these cases, ClariNet builds a survival curve but with survival probability as zero from Value Date until the Coverage End date. This means that when you value the Case in ClariNet, it will have a payment of NDB with 100% probability immediately following the NDB Collection Lag after the Value Date. There will be no payment of Premiums or Fees.

Case State: Maturity Claim Paid or Sold/Surrendered

For these cases, no survival curve is constructed and the Case is valued at zero.

Realized IRR Calculations

For Realized IRR to be calculated, the Case must have a Purchase Date and Purchase Price specified in the Cost/Maturity/Disposal tab. There are two Realized IRR calculation modes in ClariNet:

- Without Historic Payments; and

- With Historic Payments.

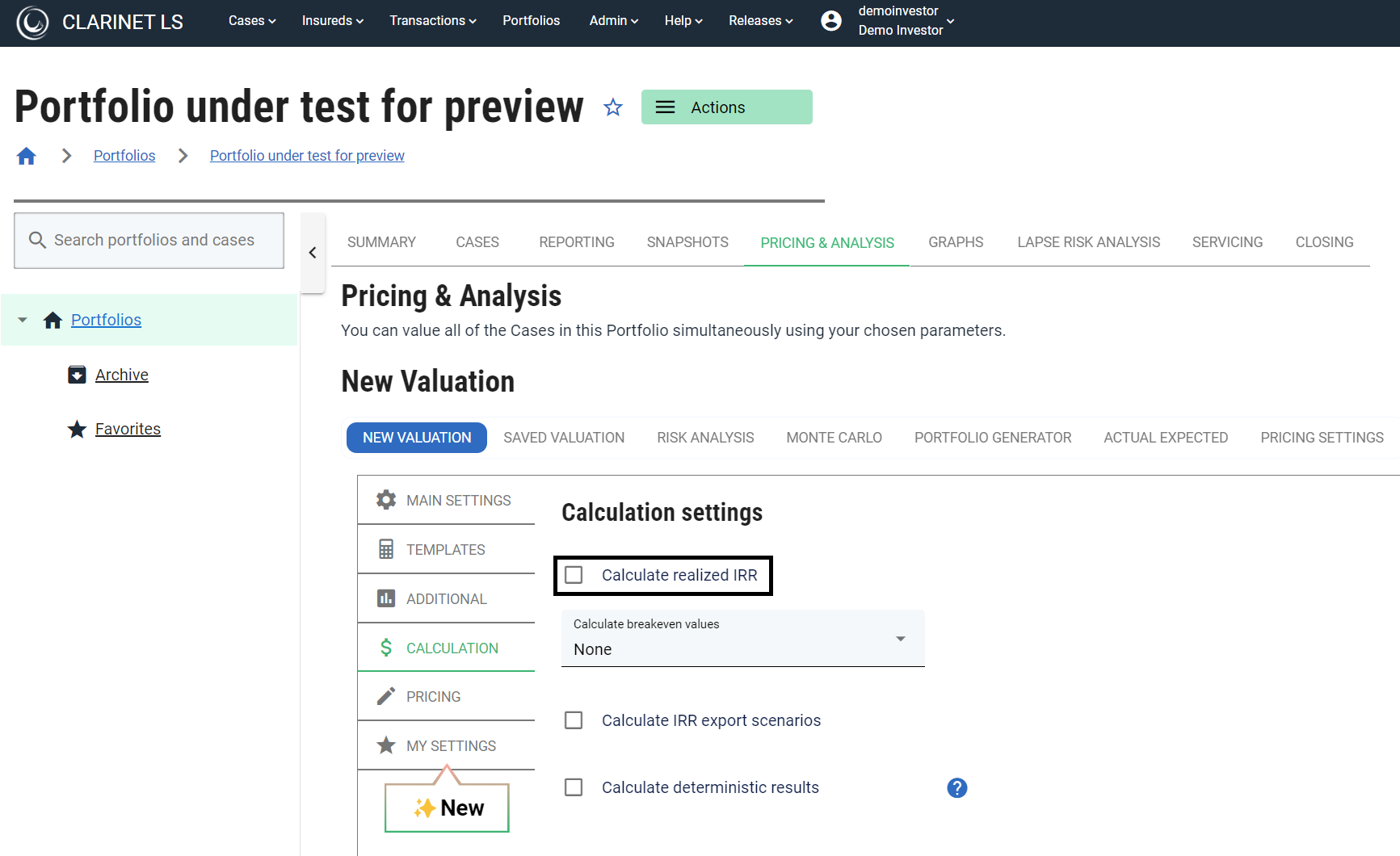

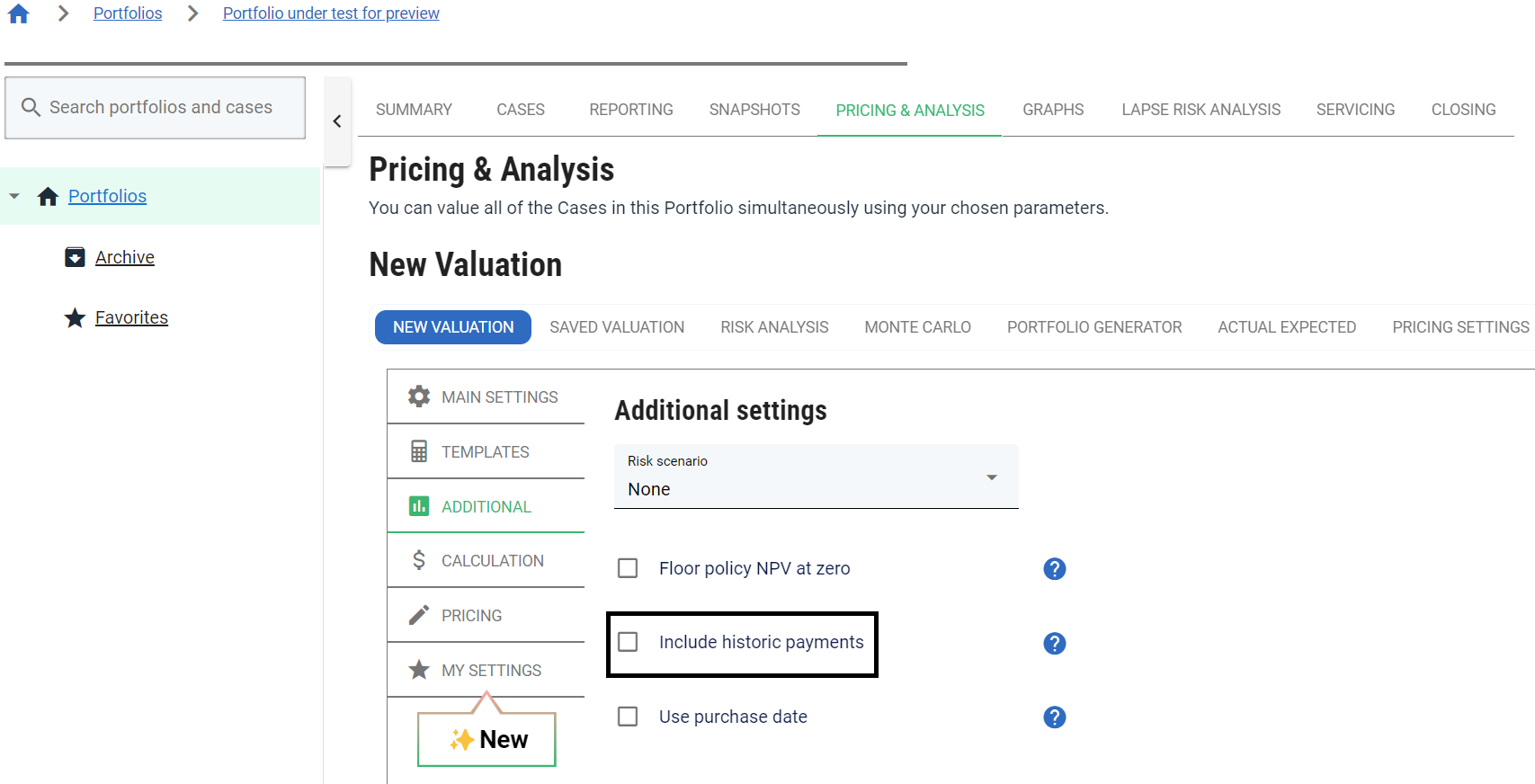

The calculation mode is set here on the Portfolio Valuation page

Without Historic Payments

The IRR is calculated such that all future cash flows are discounted back to the Purchase Price on Value Date. The future cashflows will include expected NDB (this expectation can be deterministic or probabilistic, depending on the Pricing Type), Premiums (based on the Used Premium Schedule for the Case), and Fees (based on the Fees Template selected in the Valuation Template).

- For Cases with Case State “Maturity Claim Pending”, the future cashflows will be as described in section 2 and the IRR will be determined accordingly.

- For Cases with Case State “Maturity Claim Paid” or “Sold/Surrendered”, the future cash flows will match those in the Cost/Maturity/Disposal tab.

With Historic Payments

The IRR is calculated such that all past and future cashflows are discounted back to the Purchase Price on Purchase Date. The future cashflows will include expected NDB, Premiums (based on the Used Premium Schedule for the Case) and Fees (based on the Fees Template selected in the Valuation Template). Only cashflows occurring on or after the Purchase Date are included, from both the Used Premium Schedule, the Premium Payment History, and the Fee Payment History tabs in the Case view. Future cashflows are as described under the section Without Historic Payments.