IRR Calculation

Overview

In ClariNet, a case's IRR can be calculated in several places. As a recap, the IRR calculation can be summarized as solving for r in this equation (only NDB and Premium are shown for simplicity):

Where dft is the discount factor at i and lxi is the survival probability at i.

There are two parameters that are concerned with IRR calculations in ClariNet:

- Include Historic Payments

- Use Purchase Date.

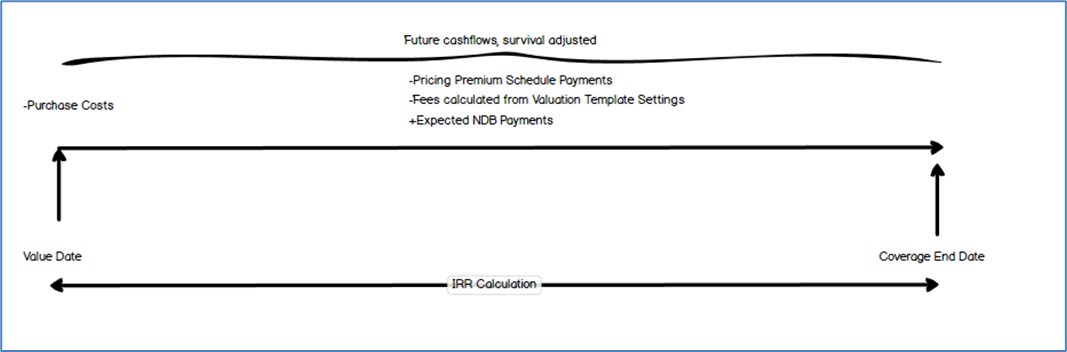

Include Historic Payments when set to false

Only active cases (those that have not matured or been disposed) will have an IRR calculated when Include Historic Payments is set to false.

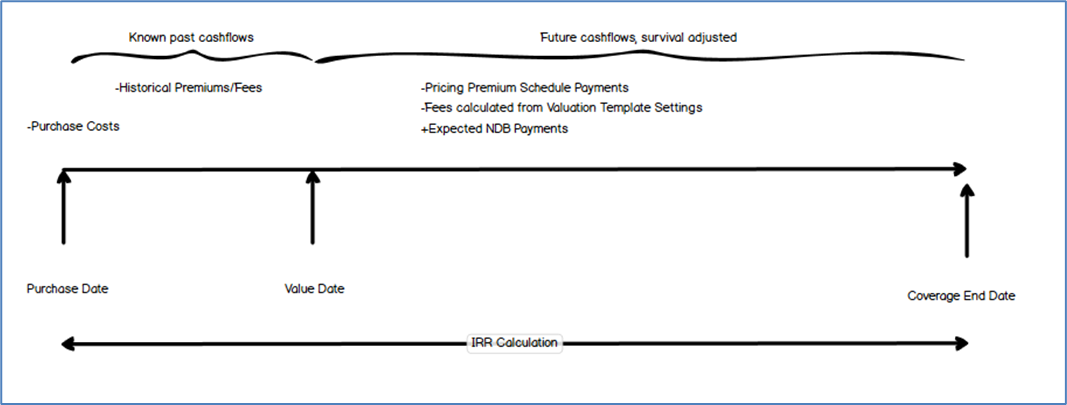

Include Historic Payments when set to true

When using Historic Payments, it’s important that you have saved Historic Cashflows, otherwise, the IRR will not be calculated since premium payments between the Purchase Date and Value date are excluded

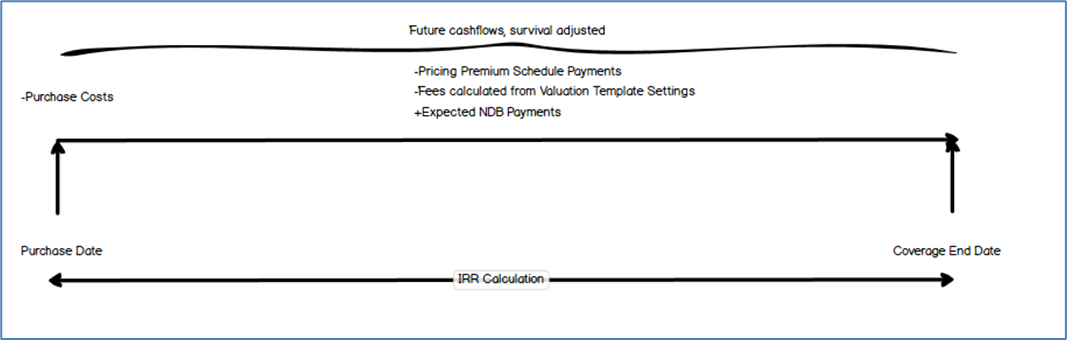

Use Purchase Date

Setting this parameter to true, when Include Historic Payments is false will lead to this calculation:

Pending Maturity Cases

When the date of death has been set on the insured(s) but maturity payment has not occurred, ClariNet will assume that N months after the date of death, a payment of NDB occurs and premiums stop. N is the NDB Collection Lag, set in the Valuation Template. Based on these cashflows, an IRR is calculated

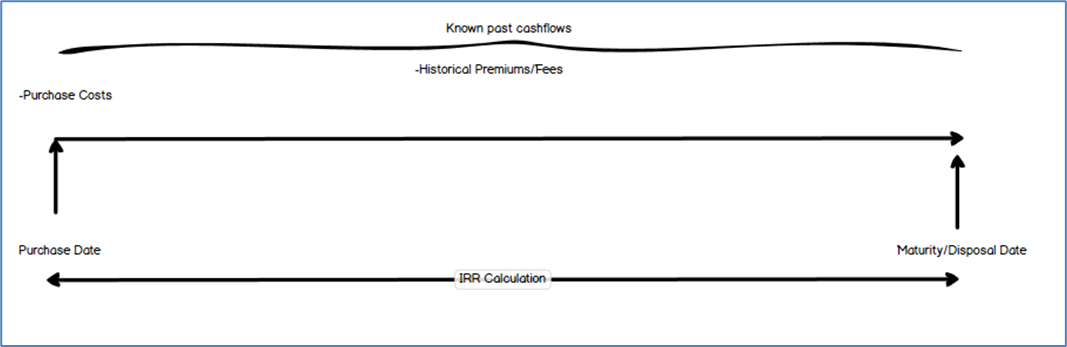

Matured/Sold Cases

In this situation, the IRR will only be calculated if Include Historic Payments is set to true.

If the Maturity Payment and Payment Date or the Disposal Date and Amount have been set, the calculation will simply assume that payment occurs on the specified date and calculate the IRR as follows: